The second quarter of 2014 started on the right foot for the restaurant industry with positive same-store sales in April — the second consecutive month of positive results, according to The Restaurant Industry Snapshot from Black Box Intelligence and People Report.

As spring weather spread throughout the country, more people were able to go out and spend their dollars on dining than in previous months, which was welcome news for the industry after abysmal sales and traffic performance during the long winter months.

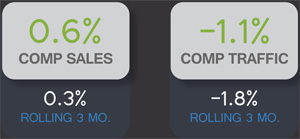

Same-store sales growth for April was 0.6 percent, a slight drop from the 0.7-percent growth reported in March, but still the first time since November 2013 that the industry has experienced at least two consecutive months of same-store sales growth.

RELATED

• Report: Restaurant sales rebound in March

• Report: February another challenging month for restaurant sales

• Sales & Sentiment Tracker at NRN.com

“Even more encouraging for the industry is the fact that this last month’s sales growth was not due to a weak April 2013, but on the contrary meant that on a two-year basis same-store sales growth was approximately 1.5 percent,” said Victor Fernandez, executive director of insights and knowledge for TDn2K, parent company of Black Box Intelligence and People Report.

Same-store traffic fell 1.1 percent for April, a 0.1-percent improvement from March’s reported growth. Furthermore, April represented the best monthly result for traffic growth since November of last year and the third best month since April of 2013.

“Given that the industry’s main challenge continues to be its declining year-over-year guest counts, April’s traffic growth showed some much-needed progress,” said Fernandez. “It also highlights the fact that there is still a challenge for restaurateurs, as the industry is yet to achieve a quarter of improving same-store guest counts since the end of the recession.”

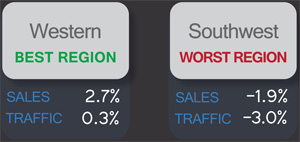

For the second consecutive month, the Western U.S. was the best performing region, with a 2.7-percent increase in same-store sales and a 0.3-percent rise in same-store traffic in April. The worst performing region for the second time in the last three months was the Southwest, with same-store sales falling 1.9 percent and same-store traffic declining 3.0 percent.

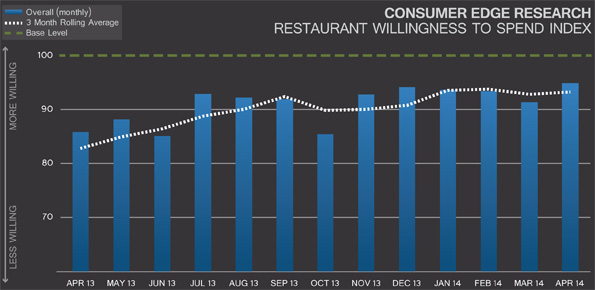

The Restaurant Willingness to Spend Index, published by Consumer Edge Research, was 95 points in April, a 3-point improvement from its value reported for March.

“The fact that this is the highest value in over three years for this forward-looking index measuring consumer expectations suggests May could be another good month for the restaurant industry,” said Fernandez. “The strong job growth seen in the overall economy during April, which was the highest in more than two years, also supports the idea of a strong May for restaurant sales.”

Year-over-year job growth in the restaurant industry during March remained flat, at 3.8 percent, according to People Report. Meanwhile, the industry experienced mixed results when it came to retention during March. Turnover for hourly employees continued to creep up, while turnover at the restaurant management level decreased for the first time since October of 2013 when measured on a rolling 12-month basis.

The Restaurant Industry Snapshot is a compilation of real sales and traffic results from over 180 DMAs from 100+ restaurant brands and over 18,000 restaurants that are clients of Black Box Intelligence, a TDn2K company. Currently, data is reported in four distinct segments: casual dining, upscale/fine-dining, fast casual, and family dining. Black Box Intelligence is a sister company to People Report, which tracks the workforce analytics of one million restaurant employees. TDn2K reports on over 30,000 restaurant units, one million employees and 40 billion dollars in sales. The Restaurant Industry Snapshot also includes the Restaurant Industry Willingness to Spend Index from Consumer Edge Research, a monthly household survey of more than 2,500 consumers.