This post is part of the On the Margin blog.

This post is part of the On the Margin blog.

Slowing sales and foodborne illness outbreaks have largely wiped out Chipotle Mexican Grill’s stock premium. But some analysts and investors think it needs to fall even further.

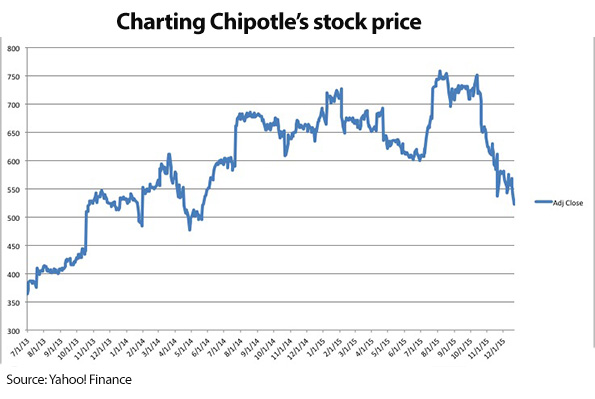

As of closing yesterday, Chipotle’s stock has fallen by more than 30 percent since it closed at more than $750.42 per share on Oct. 13. It has fallen by 18 percent since Oct. 30, the day before news of the E. coli outbreak was announced.

On Tuesday, the stock fell below $500 a share for the first time since May 2014, after JP Morgan analyst John Ivankoe downgraded the chain’s stock the day after the CDC revealed a potentially new E. coli outbreak in additional states.

All told, Chipotle has lost about $7 billion in market cap since mid-October.

The company is now trading much closer to its peers, with an enterprise value multiple of more than 15 times cash flow. That’s not in the same league as up-and-coming growth chains like Shake Shack Inc., Wingstop Restaurants Inc. and Zoe’s Kitchen Inc., all of which are trading at multiples of between 21 and 29 times cash.

But it is still more valuable than established concepts in Chipotle’s generation, like Buffalo Wild Wings and Panera Bread, which are both trading at multiples of about 12.

Some argue that Chipotle is entering an era of slower sales growth combined with higher costs and, perhaps, lower quality, because it has to change the way it sources and prepares food in response to outbreaks.

“Wall Street does not yet realize that the additional testing and training are not costs that can be recouped,” said Nick Mazing, founder and portfolio manager with Ampera Capital, which specializes in consumer stocks like restaurants. “Serving safe food is a baseline expectation. It does not merit a premium.”

Mazing prepared a lengthy presentation in which he argues that Chipotle’s stock has room to fall still, even with the recent decline in its stock price.

And he believes that the chain’s fresh food image is likely to diminish because it is modifying its preparation methods to prevent more outbreaks.

Mazing also argues that there is a declining appetite for restaurant growth stocks on Wall Street, noting that Shake Shack Inc., Habit Restaurants Inc., Wingstop Restaurants Inc., Fogo de Chao, Del Taco and Buffalo Wild Wings have all declined in recent months.

Another analyst, Howard Penney with Hedgeye Risk Management, put Chipotle on his “short” list back in September, when he noted that the company’s detractors were “getting more aggressive exposing the hypocrisy of the company.”

Penney noted that the company’s stock would adjust to lower margins and returns. He also said the company has a limited ability to raise prices, while slowing traffic should result in lower same-store sales growth. And he said that the company’s capital spending over the next five years would generate lower returns.

He was also highly critical of the company’s foodborne illness outbreaks. “There will probably a time in the future to go long this name once again, but that time is far away,” Penney wrote. “This latest outbreak of foodborne illness … has caught national attention and is causing even their most loyal customers to think twice before eating a burrito.”

Chipotle has already said that its same-store sales will fall between 8 percent and 11 percent, but some analysts believe the repeated incidents could have an even greater impact on the chain’s fourth quarter sales.

Chipotle’s sales can certainly come back. But it’s also in uncharted territory, with five outbreaks this year — or six, if the outbreak in Oklahoma and Kansas represent a second incident. Foodborne illness outbreaks are common at restaurants, but not at a single chain with this level of frequency.

On top of that, Chipotle has established itself as a new kind of restaurant that serves “food with integrity.” How much its lost reputation costs in terms of sales over the long term is key to the chain’s future sales, and its stock price.

Contact Jonathan Maze at [email protected]

Follow him on Twitter: @jonathanmaze