The restaurant industry posted 1.8-percent same-store sales growth in the second quarter, despite a decline in year-over-year growth of guest counts, according to TDn2K’s Black Box Intelligence through The Restaurant Industry Snapshot for June, based on weekly sales from over 22,000 restaurant units representing $55 billion dollars in annual revenue.

The same-store sales growth represents a 1.1-percent slowdown from the growth rate reported for the first quarter. However, the effects of severe weather during the first three months of the year render the comparison somewhat invalid.

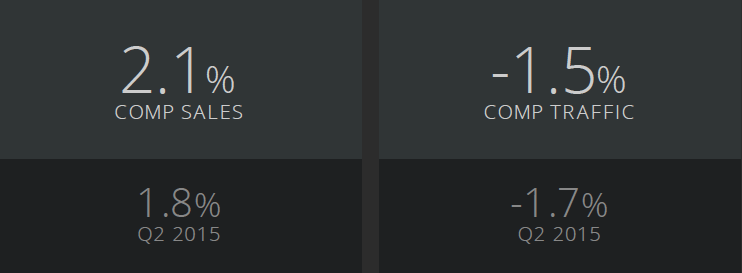

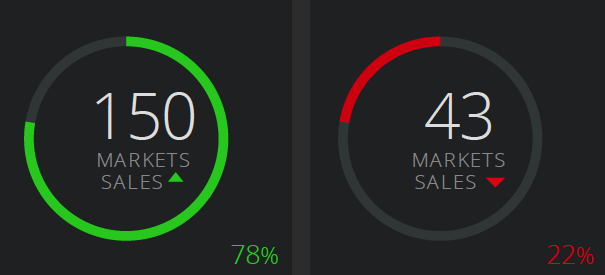

Most importantly, the industry has now posted four consecutive quarters of positive growth, with growth rates above 1 percent for each of those quarters. The average quarterly same-store sales growth during the last four quarters was 2.1 percent, a sharp turnaround from the average decline of 0.5 percent reported for the previous four quarters.

In June, the restaurant industry experienced its 11th consecutive month of strong same-store sales. Same-store sales growth this year has surpassed 2 percent in four of the last six months.

Restaurant chains continue to compete in a market share battle fueled by declining guest counts. Same-store traffic fell 1.7 percent in the second quarter, a 1.2-percent decline from the growth rate reported for the first quarter, and the worst quarter in terms of traffic growth since the second quarter of 2014. The industry has now posted three consecutive quarters of deteriorating traffic, and has yet to achieve a quarter of positive same-store traffic growth in the last four years.

“We’ve observed a clear pattern of consumer behavior since the recession. People are increasingly choosing chain restaurants less often when it comes to their dining decisions. Increased same-store sales continue to result from people spending more per visit than through visiting chain restaurants more often. Grocers, convenience stores, food trucks and other food-away-from-home options are also making the market share battle tougher for restaurateurs,” said Victor Fernandez, executive director of insights and knowledge for TDn2K.

Average check increased 3.4 percent year-over-year during each of the first two quarters of 2015. By comparison, average check increased 2.4 percent year-over-year during all of 2014.

“Consumer confidence remains relatively strong. People are feeling better than they did a year ago in terms of the economy,” Fernandez added. “They are spending more when dining out, a result of brands raising their prices, but also consumers electing to spend a little more on each visit. They are ordering that extra appetizer or dessert, or shifting their spending to pricier items within the menu. However, the one thing they are not doing is increasing their visits.”

“Consumer confidence remains relatively strong. People are feeling better than they did a year ago in terms of the economy,” Fernandez added. “They are spending more when dining out, a result of brands raising their prices, but also consumers electing to spend a little more on each visit. They are ordering that extra appetizer or dessert, or shifting their spending to pricier items within the menu. However, the one thing they are not doing is increasing their visits.”

Industry job growth continues

Regarding job growth, the labor market rebounded strongly in April and May after a sharp slowdown in March. The restaurant industry followed suit, according to the latest job growth numbers reported by TDn2K’s People Report. The number of restaurant hourly employees and managers rose 3 percent year-over-year in May, an improvement of 0.7 percent over the job growth reported for April.

With these latest results, the restaurant industry continues to prove its key role in job generation for the U.S. economy. The restaurant industry has created jobs at a pace of 3.5 percent year-over-year on average during every month since January 2014. By comparison, the U.S. economy has created jobs at an average pace of 2 percent year-over-year for all months since the beginning of 2014, according to the Bureau of Labor Statistics.

“As the economy keeps creating new jobs and the unemployment rate continues its slow descent, the competition for available employees intensifies and the incentives for current employees to pursue new opportunities also increases,” Fernandez said. “As a result, we continue to see turnover in the restaurant industry rise.”

Rolling 12-month restaurant manager turnover and restaurant hourly employee turnover increased during May. Management turnover has now increased during 11 of the last 12 months, while restaurant hourly turnover has increased steadily for 21 consecutive months. Expectations for the rest of the year indicate continued job growth, rising turnover levels and high levels of restaurant vacancies based on the People Report Workforce Index for the second quarter of 2015.

Rolling 12-month restaurant manager turnover and restaurant hourly employee turnover increased during May. Management turnover has now increased during 11 of the last 12 months, while restaurant hourly turnover has increased steadily for 21 consecutive months. Expectations for the rest of the year indicate continued job growth, rising turnover levels and high levels of restaurant vacancies based on the People Report Workforce Index for the second quarter of 2015.

According to TDn2K’s White Box Social Intelligence, of three key restaurant guest satisfaction attributes (“food”, “service” and “intent to return”), food continues to be the most prevalent, at 74 percent of all social media mentions. “Service” is becoming increasingly important. In January, 7 percent of all mentions were related to service. This percentage has been steadily increasing, and as of June, 20 percent of all posts were based on this key attribute.

Twenty percent of all online service mentions during June were positive. By comparison, 30 percent of all food mentions and 33 percent of all mentions regarding “intent to return” referred to restaurant brands in a positive light. Data suggests that although people are increasingly talking about service when they post content online, it is more likely that they do so when their experience was not positive.

The best-performing industry segment based on percentage of positive online mentions for food and for intent to return was casual dining. The segment with the highest percentage of positive service mentions was upscale casual/fine dining for the second consecutive month. The best-performing segment based on positive mentions has been either casual dining or upscale casual/fine dining for each of these three key attributes since March. According to this data, it seems that the higher the guest check, the more likely that a consumer will comment online when having a good experience at a restaurant.

The newest members of Black Box Intelligence include Darden Restaurants Inc. and TopGolf.

TDn2K (Transforming Data into Knowledge) is the parent company of People Report, Black Box Intelligence and White Box Social Intelligence. People Report provides service-sector human capital and workforce analytics for its members on a monthly basis. Black Box Intelligence provides weekly financial and market level data for the restaurant industry. White Box Social Intelligence delivers unparalleled consumer insights and reveals online brand health. Together they report on over 32,000 restaurant units, 1 million employees and 55 billion dollars in sales. They are also the producers of two leading restaurant industry conferences: Summer Brand Camp and the Global Best Practices Conference, each held annually in Dallas.