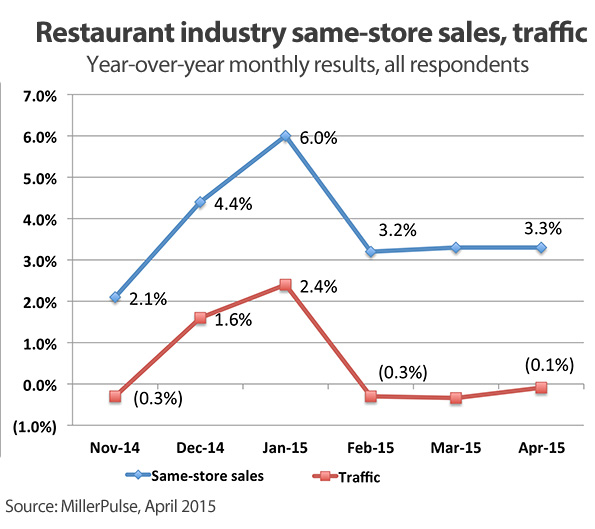

Same-store sales increased 3.3 percent in April, but traffic growth remained elusive for both quick-service and casual-dining restaurants, according to the latest MillerPulse survey.

If that sounds familiar, it’s because it is. Same-store sales rose 3.3 percent in March and 3.2 percent in February, while traffic declined slightly during both months.

Likewise, the two-year trend was 4.9-percent growth in April — the same level as in March.

“It’s remarkably unchanging,” said Larry Miller, cofounder of the survey.

Traffic fell 0.1 percent in April, according to the survey. While essentially flat, it nevertheless marks the third straight traffic decline after the industry reported traffic growth in both December and January.

“Flattish traffic is better than where it’s been, but we’ve got to get into more positive territory,” Miller said.

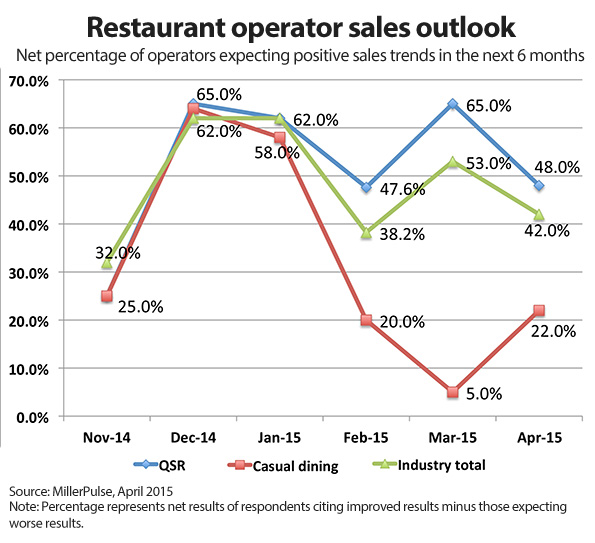

That could be difficult. Comparisons for the industry are more difficult for the rest of the year, as the industry compares itself to growth spurred by low gas prices in the latter half of 2014.

In the first 18 weeks of 2015, the industry compared itself against same-store sales that averaged 1 percent, Miller said. In the second half of the year, the average rises to 3.5 percent.

“The comparisons are harder,” Miller said. “I just don’t necessarily see traffic picking up all that much.”

However, profits should improve. Operators are expecting a sharp decline in costs over the next six months, Miller said. Food inflation is easing this year, particularly for commodities like cheese, dairy and chicken. Even beef prices, which have been near record levels, are showing some signs of easing.

Miller expects profit margins to improve as the year progresses.

“Declining costs and solid sales are a recipe for better profits,” he said.

Sales were relatively strong at both quick-service and casual-dining restaurants. Quick-service same-store sales rose 3.4 percent, while casual-dining same-store sales increased 2.5 percent. That represented an improvement for casual-dining concepts, but they continued to underperform quick-service restaurants.

Traffic for both quick-service and casual-dining operators also fell, but only slightly in both cases.

Still, casual dining sales have improved for 12 consecutive months, and while traffic growth remains elusive, those figures have improved compared with last year.

Part of the improvement in casual dining could be from the chains themselves. For years, casual-dining restaurants relied on price competition to get customers in the door. Recently, more chains have distanced themselves from that strategy to instead focus on refreshing facilities, upgrading service, adding technology and improving food.

Those efforts appear to be working.

“Really, relative value is more important than price point,” Miller said. “You’ve got to deliver a relative value to your price point. At some point, you’ve got to take your medicine. What’s wrong with our business? Why is it we’re having negative traffic month after month.”

Contact Jonathan Maze at [email protected].

Follow him on Twitter: @jonathanmaze