MINEOLA N.Y. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

As companies’ 2007 proxy statements conforming to the new requirements became available, HVS Executive Search, a head-hunter firm based here that also consults on compensation for hospitality clients, examined the pay practices of 60 restaurant companies. The HVS study found that compensation plans of a majority of the companies now seem to deemphasize base salary. Instead, the plans feature lucrative long-term incentives like stock awards and options as well as short-term windfalls like cash bonuses tied to performance that grow as companies increase in size. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

“Shareholders and activists are savvier,” said David Mansbach, HVS’ managing director for the restaurant division. “Compensation committees want to put together a program that makes sense and is strategic now that it’s easier for everyone to see.” —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

Compensation experts share the view that incentive pay components increasingly are moving toward overtaking base-salary amounts, although the non-retroactive U.S. Securities and Exchange Commission disclosure rules prevent analysts from making detailed comparisons of pay packages for 2006 with those from prior years. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

Nonetheless, in the wake of the new disclosures, some companies have come under fire for what critics view as excessive compensation. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

For example, the shareholder advisory firm Proxy Governance Inc. recently criticized the pay package for Tilman Fertitta, chief executive of Landry’s Restaurants Inc., as being “out of line” with those of comparable companies. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

The firm said Fertitta’s pay last year was 351 percent above the median for chief executives of “peer companies.” —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

Houston-based Landry’s owns some 180 restaurants in about 30 states, including the Landry’s Seafood House, Rainforest Cafe, Chart House and Saltgrass Steakhouse chains and two Golden Nugget hotel-casinos in Nevada. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

Fertitta received a base pay of $1.4 million, a $1.5 million bonus, $883,409 in other compensation, and $11.4 million in stock awards. His total compensation was $15.3 million. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

He also was ranked by the HVS study as the highest-paid chief executive of the 60 surveyed in terms of total CEO compensation. No. 2 was James Donald of Starbucks Coffee Co., at $13.7 million, who oversees the Seattle-based Starbucks system’s more than 14,000 coffeehouses worldwide. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

No. 3 was Jim Skinner of McDonald’s Corp., at $12.7 million. The Oak Brook, Ill.-based company and its franchisees operate more than 30,000 restaurants. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

David Novak, chief executive of Yum! Brands Inc., was No. 4 in HVS’s ranking, with annual compensation last year that totaled $12.4 million. Yum, based in Louisville, Ky., is the parent of such brands as KFC, Taco Bell, Pizza Hut and Long John Silver’s that total more than 34,000 units. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

Fifth-highest in chief executive compensation was John Chidsey of Burger King at $11.7 million. Miami-based Burger King and its franchisees own more than 11,100 restaurants. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

The HVS report looked at base salary, nonequity incentives, bonuses, stock awards, option awards and all other compensation to calculate total compensation for the 60 companies’ chief executives. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

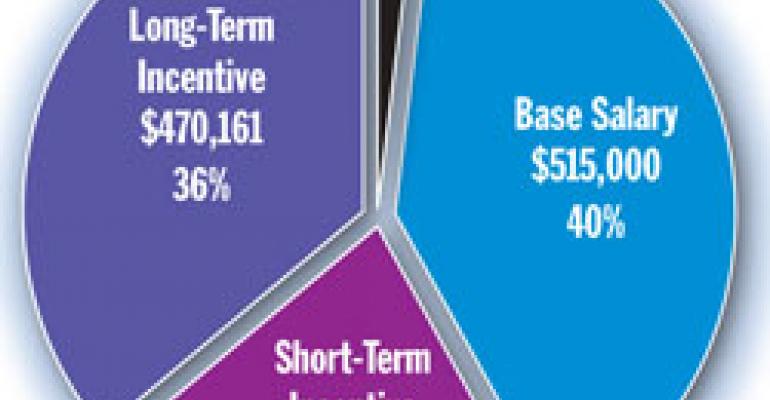

Their median base salary was $515,000, which accounted for 40 percent of the total CEO compensation. Long-term incentives in the form of stock and option awards comprised the second-largest component, representing 36 percent of the total, or an average of $470,161. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

The median short-term incentives of nonequity rewards and bonuses were 22 percent of total compensation on average, or $286,500. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

Top total CEO compensation*

| RANK | CEO & COMPANY | TOTALCOMPENSATION | |

| 1 | Tilman Fertitta,Landry’s Restaurants Inc. | $15,328,909 | |

| 2 | James Donald,Starbucks Corp. | $13,780,609 | |

| 3 | Jim Skinner,McDonald’s Corp. | $12,709,492 | |

| 4 | David Novak,Yum! Brands Inc. | $12,432,093 | |

| 5 | John Chidsey,Burger King Holdings Inc. | $11,700,702 | |

The report also divided companies into three groupings by market capitalization as of Oct. 4 to examine salary differences according to the size of restaurant chains. Based on shares outstanding, companies were grouped by aggregate stock values less than $250 million, between $250 million and $1 billion, and greater than $1 billion. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

Base pay was a greater percentage of total compensation for chief executives of smaller companies, but as companies increased in market cap size, so did the percentage of long-term incentives as a part of total compensation. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

Among the smaller companies, base salary was 55 percent of a chief executive’s total compensation, with an almost even split then between short- and long-term incentives. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

For the midsize companies, all three components were almost evenly split. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

But in larger companies, base salary was only a quarter of total compensation; long-term incentives were 41 percent of the total compensation while short-term incentives were 26 percent. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

“You want these individuals thinking short-term and long-term,” Mansbach said. “It’s harder to be objective on a longer-term strategy if [long-term] incentives are not tied to your compensation program.” —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

Compensation committees are trying to be more strategic about how chief executives are paid, he said. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

“Companies are really getting that compensation and pay-for-performance is really on [shareholders’] radar, and it’s also the right thing to do to be successful,” Mansbach said. Pay-for-performance programs have been increasing in public companies across all industries, said Shirley Westcott, managing director of Proxy Governance, the Vienna, Va., shareholder advisory firm that had been critical of Fertitta’s pay at Landry’s. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

“We’ve been seeing in recent years more of a shift from plain-vanilla stock options to full-value shares and restricted shares,” Westcott said. “CEOs are being awarded for time on the job and for meeting certain performance hurdles for those shares to actually vest.” —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

Despite efforts to make CEO pay methods transparent, shareholders are asking for even greater disclosure, she said. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

“Many investors would like companies to disclose the numerical performance hurdles for CEOs, but they are not required to do so,” Westcott said. “The SEC still finds the discussion is not clear enough to know how the pay packages are being designed to ensure they are sufficiently tied to performance.” —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

She forecast that regulators and companies would confront proposals to require “more performance-based awards, better benchmarking in determining incentive pay, and pay for superior performance.” —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

One proxy proposal the SEC may be asked to consider is “say on pay,” a rule that would give shareholders an advisory vote on CEO compensation, Westcott added. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

In April, the U.S. House of Representatives approved a bill that would require publicly owned foodservice and other companies to submit executive pay packages to nonbinding votes of shareholders. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.

The say-on-pay measure, which passed by a 269-134 House vote, would require that shareholders’ yeas and nays on the compensation of “principal executive officers” be solicited via proxy materials distributed for annual meetings taking place after Jan. 1, 2009. Such votes would not supersede corporate boards’ pay decisions but would express the sentiments of stockholders, proponents of the law said. —A new snapshot of chief executive pay packages at publicly traded restaurant chains shows apparently growing emphasis on cash incentives and stock awards since federal securities regulators began requiring companies to disclose details of compensation packages for top executives and directors.