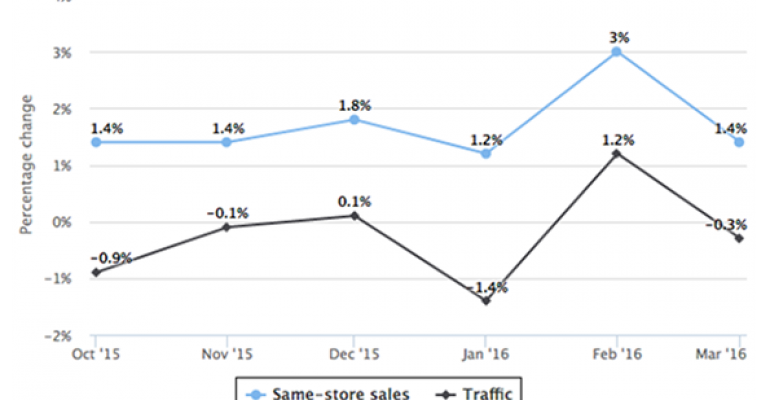

Same-store sales growth slowed to 1.4 percent in March, according to the latest MillerPulse report, continuing a volatile year for restaurant industry sales that has seen wild swings from one month to the next.

The 1.4-percent growth marked a substantial decrease from the 3-percent growth in February, and was due largely to weak traffic: According to the monthly survey, traffic fell 0.3 percent in the month.

“We’ve been exceptionally volatile all year,” said Larry Miller, co-founder of the MillerPulse survey. “It’s really hard to gauge any kind of trend.”

At least part of the problem is calendar-related this year. February included an extra day, Leap Day, which would have pulled up sales, while March included Easter, which might have pulled sales down.

Still, the two-year trend — which eliminates one-time event like calendar shifts — was 5 percent, falling from 6.7 percent in February and the lowest level since November.

“It appears to be slowing overall,” Miller said.

Still, Miller said that it was “a good first quarter that shouldn’t shake anyone’s confidence.”

Much of the volatility was in the quick-service sector. Same-store sales in the segment grew just 0.4 percent in January, jumped to 3.5-percent growth in February and fell back to 1.4-percent growth in March.

Similarly, quick-service traffic fell 0.9 percent in January, increased 2.9 percent in February and fell 0.1 percent in March.

Miller said there are some signs of quick-service weakness in some markets.

“When you start dissecting QSR, you see problems in certain regions of the country,” Miller said. He said same-store sales are weak in some Western states, as well as in Texas.

Casual dining has been steadier than quick service, and there are signs of improvement.

Same-store sales rose 1.5 percent in March, a decrease somewhat from February’s 2.5-percent growth. Much of that was due to the Easter holiday, and Miller noted that moderate casual dining, like bar and grill chains, had the weakest results, while higher-end casual dining, which likely got business over the Easter holiday, was stronger.

Casual-dining traffic fell 0.5 percent, similar to the 0.4-percent traffic decline in February, holding to a trend that had improved over the previous four months.

“There’s a lot of value offer at QSR,” Miller said. “They’re probably drawing maybe less loyal casual-dining customers away.”

Contact Jonathan Maze at [email protected]

Follow him on Twitter: @jonathanmaze