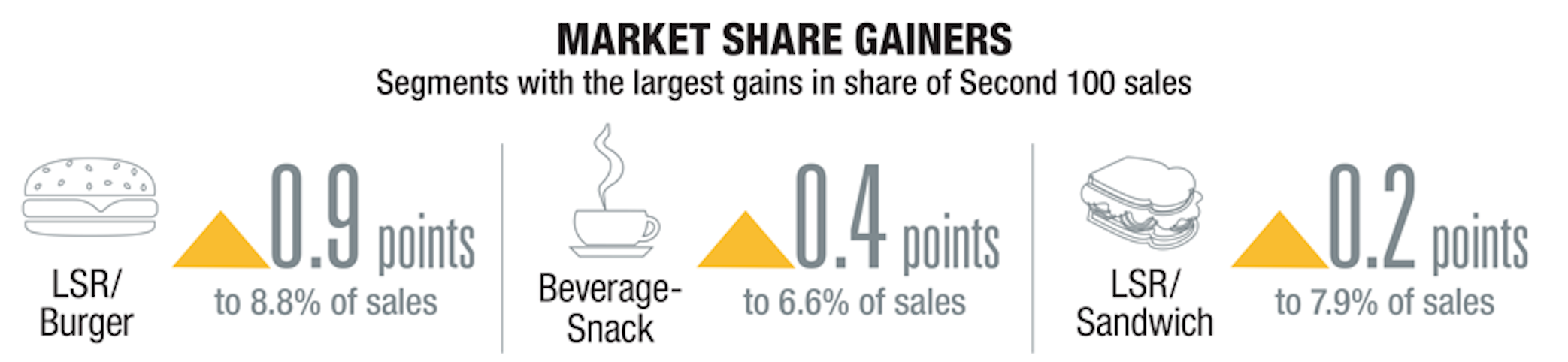

Beverage-Snack and Limited Service/Burger led in market share gains among segments in the Latest Year Second 100.

Other segments showing market share increases in the Second 100 included: Bakery-Cafe, Limited Service/Specialty, Limited Service/Mexican and Limited Service/Sandwich. Common themes in these segments include minimal wait staff, modest prices and speed — all popular benchmarks in fast casual.

The Beverage-Snack market share made up 6.6 percent of the Second 100 chains’ Latest Year sales, up from 6.3 percent in the Preceding Year, and LSR/Burger market share rose to 8.8 percent of the Second 100 sales in the Latest Year, up from 7.9 percent in the Preceding Year.

Second 100 segments showing shrinking market share in the Latest Year were Buffet/Grill-Buffet, Casual Dining, Family Dining, In-Store and Pizza. Competitive pressures from the fast-casual brands continued to chip away at the traditional full-service segments.

Of the segments that lost share, Pizza suffered the smallest erosion, with a dip of 0.04 percentage points.

In the buffeted Buffet/Grill-Buffet segment, which saw a number of closures with the bankruptcies and closures of HomeTown Buffet and Ryan’s Grill, Buffet & Bakery units, Sizzler became a standout in change of market share among the Second 100 brands.

Sizzler booked a 5-percentage point increase in segment market share in the Latest Year, and Sweet Tomatoes gained 3.2 percent in market share as Hometown and Ryan’s shares slipped.

Kerry Kramp, president and CEO of Sizzler USA, said, “We’ve had same-store sales increase eight years mostly because we have been adapting to what we believe is a pretty dramatically changing consumer.”

The brand has been retooling menus and trying to distance itself from the one-price-all-you-can-eat model by emphasizing a la carte items that can be sold individually or bundled with a side salad or an unlimited salad bar.

“We are trying to attract Millennial families without leaving the existing Baby Boomer behind,” Kramp told Nation’s Restaurant News. A 1991 vintage promotional video for Sizzler also became a 2015 sensation, adding brand awareness and updating the brand’s image.

Other standouts in the Latest Year were smaller and freshly public restaurant brands like Zoës Kitchen and Shake Shack.

Shake Shack increased its market share among LSR/Burger chains by 2.4 percentage points, to take 8.6 percent of Latest-Year segment sales.

Shake Shack, which went public in January 2015, saw its fourth-quarter 2015 same-store sales increase 11 percent.

“We are very proud of what we have been able to accomplish in our first year as a public company,” said Shake Shack CEO Randy Garutti in a statement. “2015 marked a record year for Shake Shack in nearly all metrics, and we will continue to execute our stated growth strategy and connect with guests the world over.”

Zoës Kitchen, which went public in 2014, increased its market share in the Latest Year by 2.2 percentage points, to 12 percent of LSR/Specialty sales, with unit growth and same-store sales increases. Sales were fueled by a 17 percent increase in fiscal 2015 catering sales, the company said.

“Catering continues to be a key element in our overall strategy and is contributing to our overall results,” said Kevin Miles, president and CEO of the fast-casual Mediterranean chain, during a February call with analysts.

The Beverage-Snack category in the Second 100 saw a modest increase in market share, rising to 6.6 percent in the Latest Year from 6.3 percent in the Preceding Year. Tropical Smoothie Cafe led the pack in market share growth for the segment, with a gain of 1.8 percentage points, to take a 15.4 percent share of sales. Cold Stone Creamy retained its No. 1 spot.

Casual Dining continued to see pressure on market share in the Second 100, with the segment overall losing ground, declining as a category to 35.1 percent market share in the Latest Year from 35.8 percent in the Preceding Year.

Contact Ron Ruggless at [email protected]

Follow him on Twitter: @RonRuggless