Chick-fil-A’s unit volumes keep surging. And they’re not open Sundays.

Say anything about the average unit volumes of Chick-fil-A and someone nearby usually makes that note. That’s because it’s worth noting: The chicken sandwich chain has boasted the strongest unit volumes of any large-scale limited-service chain for years now, and it’s only open six days a week.

In 2015, those six days did Chick-fil-A even better: The chain’s estimated sales per unit grew by nearly 12 percent, to more than $3.5 million per location. No other limited-service concept in the Top 100 is even above $2.7 million.

“They avoid debt. They haven’t over-expanded, either. They didn’t get into this publicly-traded rush to develop 500 units every year,” said John Gordon, a restaurant consultant out of San Diego.

“The menus and the store experience at Chick-fil-A are far different than the typical QSR. I just invite you to go into a Chick-fil-A and compare the menu board with other QSRs. It’s streamlined.

Top performers have double-digit gains

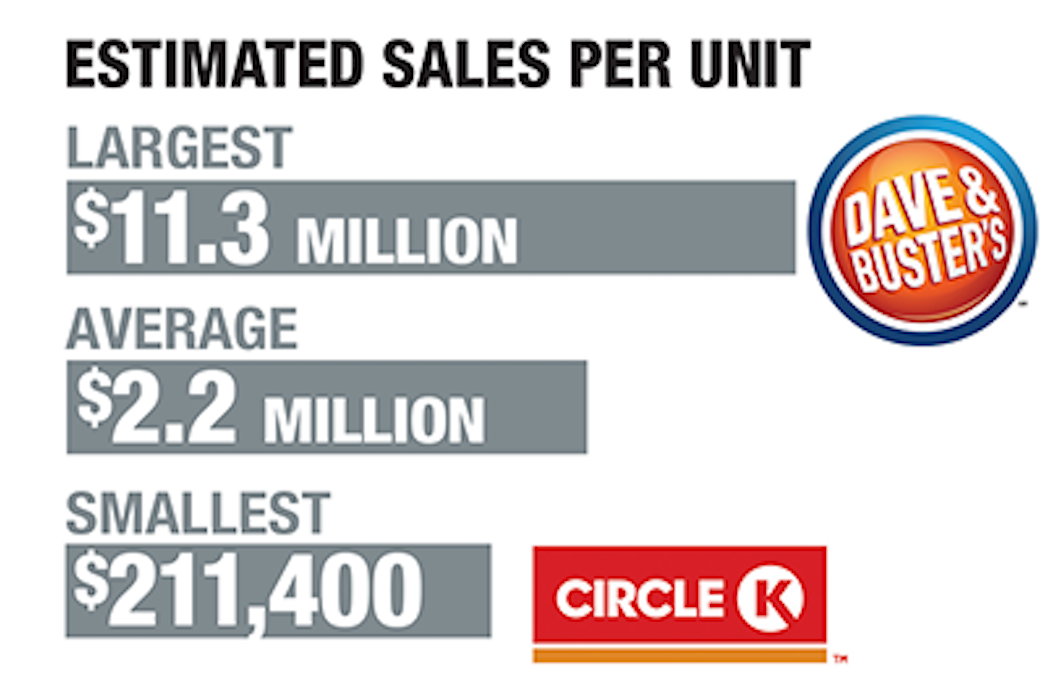

But Chick-fil-A was hardly alone in enjoying strong sales growth last year. Nor did it even boast the strongest growth in estimated unit sales. That title went to another chain on an impressive streak: Domino’s Pizza, where estimated sales per unit increased 14.5 percent to $937,100 — overtaking rival Papa John’s Pizza.

Domino’s has generated strong same-store sales thanks largely to its ease of ordering. The company has introduced new, easy ways for customers to order pizza and has cleverly marketed that technology to customers in an age when convenience is vital.

One other concept had estimated sales per unit above 10 percent: Dairy Queen, where estimated sales per unit rose 10.2 percent to $790,100.

Dairy Queen in recent years has worked to move away from its reliance on treats, which consumers eat only once in a while. The chain now focuses more on lunch and dinner occasions. The restaurant introduced the $5 Buck Lunch in 2013 to great success, and unit volumes have followed. In the two years since that introduction, the chain’s estimated sales per unit have grown 19 percent.

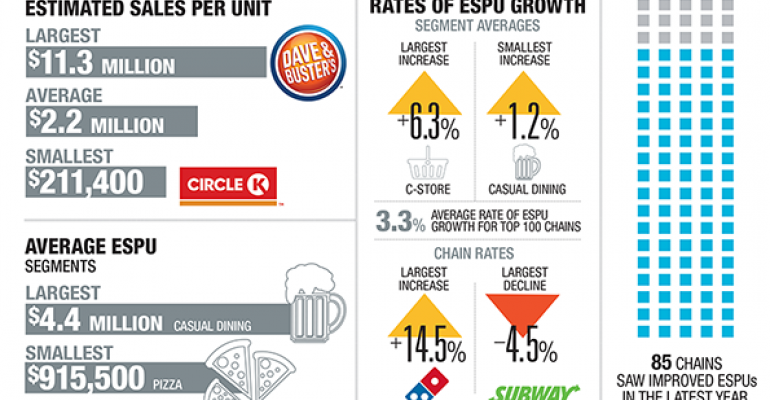

Sales per unit grew across industry

Overall, estimated sales per unit for the Top 100 grew 3.3 percent, while average unit volume for the entire list was nearly $2.2 million. The increase in sales per location helped the largest 100 restaurant chains grow total system sales by nearly 6 percent in 2015 — the best performance for the companies on the ranking in nearly a decade.

“Consistency was the new normal,” said Larry Miller, cofounder of the MillerPulse restaurant sales index. “It was a good start to the year, then it was very consistent.”

The largest volume chains were casual-dining concepts. Dave & Buster’s, the casual-dining-and-games chain, had estimated sales per location of $11.3 million. That was

up nearly 5 percent from the year before.

Dave & Busters restaurants are more like vast entertainment complexes, and are as big as 65,000 square feet. The company gets more of its revenue, in fact, from games and amusement than it does food and beverage.

Close behind was The Cheesecake Factory, where estimated unit volumes were $10.5 million, up 1.2 percent.

Growth among concepts’ estimated unit volumes reflected the direction of the different restaurant sectors, albeit not entirely.

Which segments saw growth?

Generally, the most growth came among limited-service concepts. They included Tim Hortons, with an increase of 9.6 percent, Arby’s, with an increase of 9.5 percent and Starbucks Coffee, with an increase of 9.2 percent.

But nontraditional concepts also attracted more sales per location. Wawa’s estimated unit sales rose 9.9 percent, for instance, to $2.3 million, faster than all but three other concepts.

Similarly, Casey’s General Store’s unit volumes rose 9 percent to $461.8 million. And the typical Costco sold $1.6 million in prepared food, up more than 7 percent. All increased at a faster rate than any casual-dining concept.

That makes sense. Casual-dining concepts have higher unit-level volumes and thus it’s more difficult to increase their sales. But they have been steadily losing ground to fast-casual restaurants and quick-service concepts for the better part of a decade.

Contact Jonathan Maze at [email protected]

Follow him on Twitter at @jonathanmaze