What’s for dinner tonight? That’s the question many restaurant operators think is the most important to answer when it comes to competing with the growing array of retail outlets that offer prepared foods.

But according to a new report from The NPD Group, it’s not ready-to-eat meals at dinner but those at dayparts such as breakfast and snack that pose the biggest competitive threat to restaurants, especially those in the quick-service segment.

“Everyone thought the threat was was at the dinner daypart, but it’s the smallest piece of the pie,” said NPD analyst Bonnie Riggs. “I don’t think operators are aware of that.”

Consumers are turning more to retail outlets, including food and drug, discount and department stores, and price clubs, for prepared meals and snacks, according to the Port Washington, N.Y.-based firm’s recently released Retail Meal Solutions report. The report examines how retailers, excluding convenience stores, are satisfying consumers’ needs for ready-to-eat meals and snacks consumed within six hours of purchase.

As reported by NPD, 6 percent of the roughly 62 billion commercial foodservice meals and snacks consumed in a year are purchased at retail stores. Retail ready-to-eat meal and snack purchases increased 2 percent for the 12 months ended August 2008. During the same period, meal and snack purchases in quick service grew only 1 percent, and the full-service restaurant segment saw such sales drop.

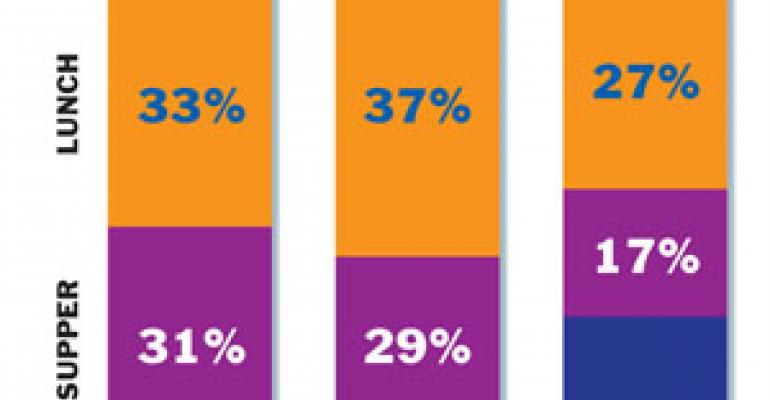

Though dinner is widely thought of as the prime daypart for ready-to-eat meals and snacks, breakfast and evening snacks are actually the key purchase times at retail outlets, NPD found. In the 12 months ended August 2008, dinner accounted for just 17 percent of retail ready-to-eat meal and snack traffic. The evening snack period captured the largest share, with 35 percent; followed by lunch, with 27 percent; and morning meal, with 21 percent.

Retail is experiencing its strongest traffic growth where its quick-service competitors are weakest, NPD found. In the 12 months ended August 2008, dinner traffic grew 5 percent at retail outlets, while dinner traffic at quick-service outlets declined 1 percent.

“Dinner at retail is where the growth is occurring,” Riggs said. “Even though it’s the smallest piece, they are providing the biggest option.”

Consumers seek out different eating options at different retail outlets, NPD found. In the year ended August 2008, consumers visited food and drug stores and discount department stores most often for an evening snack. They visited price clubs most often for lunch.

Convenience, the availability of more healthful options, and variety and affordability are among the factors motivating consumers to purchase prepared meals and snacks from retail stores, according to the report. Riggs said these are attributes consumers report lacking at quick-service restaurants.

When shopping for ready-to-eat meals and snacks, the foods consumers most often purchase from retail outlets are salty snacks; fried and nonfried chicken, such as rotisserie chicken; candy or candy bars; pizza; and doughnuts.

“If I were a chicken chain…a pizza place… I would be really concerned,” Riggs said, noting that chicken and pizza are among the top foods moving through retail.

Retail consumers are most likely to grab ready-to-eat foods from the deli or a stocked shelf, according to the data. More than one-third of all retail purchases are made from stocked shelves and slightly more than one-third are made from the deli.

The report’s so-called “other” category, which includes such foods as sushi and rotisserie chicken that consumers could not easily categorize, accounted for the next largest share of purchases at 12 percent, followed by in-store bakery purchases at 11 percent, and salad or food bar purchases at 7 percent. In-store restaurants captured the smallest share of purchases, at just 4 percent.

No matter where retail meals or snacks are purchased, the majority of them are eaten in the home, NPD found. In the 12 months ended August 2008, 17 percent of all dinner meals, 13 percent of all snacks and 8 percent of all lunches purchased at retail were eaten at home.

A number of retailers are going directly after take-home diners. Among the first to do so were Whole Foods and Publix.

Two years ago Lakeland, Fla.-based Publix launched an effort to further expand its prepared-foods business by unveiling a pilot 4,500-square-foot prepared-foods section at its Lake Mary Collection, Fla., store. Since then, the 1,002-unit supermarket chain has continued to expand its prepared-food offerings at that location and others.

Explaining the chain’s success with its prepared-foods offerings, Publix spokesman Dwaine Stevens said, “It’s the convenience factor…it’s the quality of it…it’s the restaurant-type food.”

Lunch has always been the biggest daypart for the supermarket’s prepared foods, and it has seen continued growth through the ongoing expansion of offerings, said Stevens, who predicts that supermarket prepared foods will continue to grow at all dayparts.

“[Consumers] need to identify with a grocery store that they provide hot prepared foods,” Stevens said. “I believe that’s going to take time.”

While supermarkets seem like a natural competitor to restaurants for ready-to-eat foods, less obvious, but no less a threat, are supercenters and warehouse clubs.

“Supermarkets getting into prepared meals is not new; what’s new is they’re getting effective at it,” said Dennis Lombardi, executive vice president for Columbus, Ohio-based WD Partners, a consulting firm specializing in design and development. “It’s working for supercenters because it’s playing to convenience.”

Bentonville, Ark.-based Walmart is among the many supercenters trying to take a bite out of the restaurant industry’s market share. In October 2008, the big-box retailer launched in Arizona its first four pilot Marketside stores, described as “community grocery” stores designed to offer restaurant-quality food at everyday low-prices. In addition to picking up grocery items, Marketside shoppers can also grab what they need from the store’s butcher, bakery or deli, and choose from a variety of value-priced prepared foods, such as personal-size hearth-baked pizzas for $4, individual portions of lasagna for $6 and family-sized penne pasta with chicken for $8.

Lombardi notes that some chains have introduced new products that would seem to directly counter prepared retail offerings, such as Pizza Hut’s new pastas.

Dallas-based Pizza Hut launched last April a new line of family-sized baked pastas with breadsticks for just $11.99 that are similar to prepared pastas available at many retailers. The pizza chain has had great success with the line, recently telling Nation’s Restaurant News that it had rung up $500 million in pasta sales since the line debuted and that it plans to roll out different pastas over the next two years.

But to better compete with retail outlets, restaurant operators need to do more than simply counter existing dinner dishes, say industry experts.

“Really they need to be paying attention to what’s moving at breakfast, lunch and the snack occasion,” Riggs said.

While Lombardi agreed operators need to be aware of what’s working for retail outlets at non-dinner dayparts, he said restaurateurs shouldn’t try to win them all.

“[Operators] are not going to get consumers for every meal for every occasion,” he said. “Different brands need to focus on the daypart they can have. They have to continue to keep product offers more desirable than what retailers are offering.”

While they are gaining market share, retailers shouldn’t sit around counting their rotisserie chickens, Riggs said. There’s an opportunity for retailers to continue to grab market share, especially at the dinner occasion by offering more signature items and finding ways to make shopping for a complete meal easier for consumers.

“It’s still really all about convenience,” Riggs said. “Make it easy for me. Don’t make me walk down aisles to find things.”