Restaurant price increases have generally been modest over the past five years, leaving room for brands to take some pricing this year, consultant Leslie Kerr says.

“The dilemma for operators has been this reliance on deals and the need to promote the fact that it’s not too expensive to eat out,” Kerr, president and founder of Boston-based consultancy Intellaprice, told Nation’s Restaurant News Monday.

Lower gas prices and positive jobs news are allowing restaurant operators some flexibility in making selective price increases. Recent analyst calls by public restaurant companies have indicated that operators are looking to recoup more costs with price increases.

Denver-based Chipotle Mexican Grill Inc. said in early February that it does not plan to raise menu prices across the board in 2015, but it is considering a surcharge for steak and barbacoa entrées in the second half of the year if beef costs remain high. The company raised menu prices 6.3 percent in the middle of 2014.

Jack Hartung, Chipotle’s chief financial officer, said food inflation rose around 7.5 percent for the year, so the price hike did not cover the increase in costs, but the 1,783-unit fast-casual chain did not want to take two increases in the year.

“It’s important to us that we remain accessible and affordable to our customers,” Hartung said.

Fiesta Restaurant Group Inc. chief financial officer Lynn Schweinfurth said in a call last week that the Addison, Texas-based fast-casual operator raised menu prices about 1 percent at 174-unit Taco Cabana in mid-October and increased prices more than 5 percent at 161-unit Pollo Tropical in mid-November.

Full-year price increases for 2015 will be slightly more than 4 percent at Pollo Tropical and 2.5 percent at Taco Cabana, she said. Last week, Taco Cabana raised menu prices 1.5 percent.

“Overall, we believe we can bridge the dollar impact of higher costs with pricing-cost mitigation tactics and expense-saving opportunities,” Schweinfurth said.

Most brands can “stay the course,” Kerr said. “What we’ve been seeing is measured increases based on the economic realities. There hasn’t been any huge jump. … There’s nothing that sticks out as an unreasonable increase over this time.”

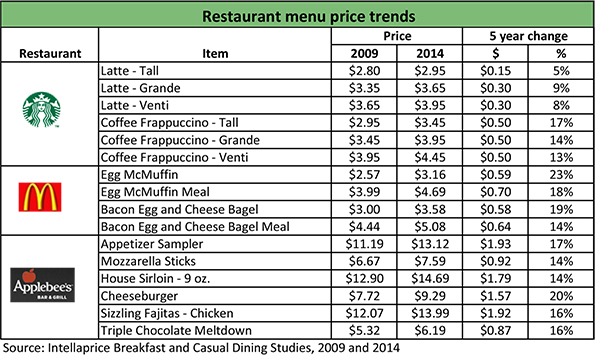

Intellaprice data collected over the past decade showed that restaurant prices have increased for specific items by anywhere from 5 percent to 28 percent at some chains.

“These figures might cause sticker shock at first blush,” Kerr said, “but on an annual basis, that’s just a few points per year, which is reasonable.”

Five years ago, a Starbucks Grande Caffè Latte was $3.35, and in late 2014, it was $3.65 in most of the country, she said. “So we’re talking about 30 cents over five years, or about 2 percent a year,” Kerr said. “Consumers can understand that and are willing to accept the small increments. It’s sound decision-making by operators.”

At McDonald’s, an Egg McMuffin cost $2.57 on average five years ago, and it now averages $3.16, Intellaprice data showed. That’s 60 cents over five years, or an increase of about 5 percent a year, Kerr said, adding that some items on McDonald’s menu have remained flat during the same period.

“Many items on the value menu are still a dollar, and coffee is often on special for $1, so it actually costs less than it did five years ago, so there is a bargain perception among guests,” she said.

Menu innovation a key ingredient

(Continued from page 1)

Casual-dining restaurants have also increased prices in small increments. An Intellaprice study showed that Applebee’s Neighborhood Grill & Bar’s nine-ounce House Sirloin averaged $12.90 in 2009. The same item averaged $14.69 in the fall of 2014, a 3-percent annual increase.

“The rising cost of beef was bad news last year from a commodities perspective, but the result for guests wasn’t all bad,” Kerr said. “In this case, they could choose to pay a bit more for the steak, or select options like 2 for $20 or new menu offerings.”

She added that operators realize that a price increase strategy must be part of the overall marketing plan and work in combination with menu innovation so “guests still feel good about the decision to dine out.”

Operators can selectively raise prices on high-traffic items. “If you are trying to make up 5 percent as an operator, you do it on the burger or the sandwich that’s popular, or the chicken entrée — the top sellers,” Kerr said.

Kerr said her general advice to clients was to “look at the big picture and don’t react quickly to any one factor,” she said. “Understand what your competitors are doing. Understand the value that your brand offers and the perception that year guests have. If you can justify price increases, feel confident in doing so.”

Restaurant brands have used menu innovation as another key ingredient in pricing strategy, Kerr said.

“We’ve seen many tactics implemented in these tough economic years: small plates and shareables, specific lunch and dinner price points, and new pairings and create-your-own options,” she said.

Contact Ron Ruggless at [email protected].

Follow him on Twitter: @RonRuggless