Nearly 30 percent of American consumers say they intend to spend less on dining out in the year ahead, according to a new survey from business advisory firm AlixPartners.

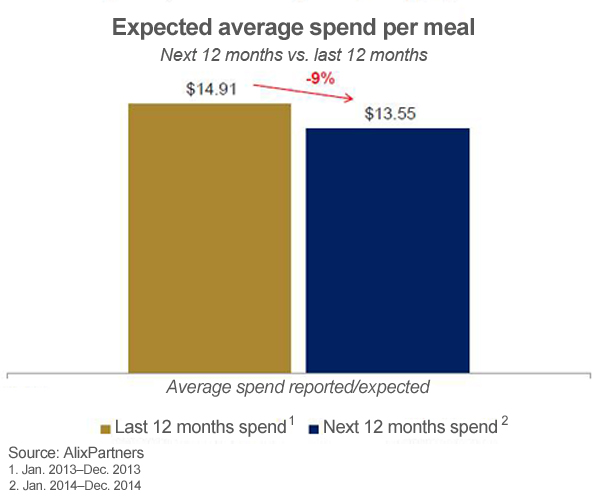

Each year the New York-based firm conducts a survey of about 1,000 consumers on dining out expectations and preferences. This year’s survey results show that diners expect to spend 9.1 percent less per restaurant meal this year, or about $13.55, compared with the $14.91 they said they spent last year per meal.

“Diners, like most American consumers today, remain stuck in the limbo of today’s seemingly one-step-forward, one-step-back economy,” said Eric Dzwonczyk, AlixPartners managing director and co-lead of the firm’s Restaurant & Foodservice Practice. “In fact, our survey suggests that restaurants may be suffering disproportionately from that phenomenon versus other types of businesses.”

RELATED

• Survey: Sustainability key to restaurant customers

• NPD: Majority of restaurant customers won’t try new menu items

• Consumer Trends at NRN.com

The percentage of Americans who dined out at least weekly over the past 12 months dropped to 57 percent, from 60 percent a year ago. The No. 1 reason for cutting back on visits was a desire to eat more healthfully. It was the second consecutive year the “eat healthier” explanation topped concern about finances as the reason for fewer restaurant visits, AlixPartners said.

Still, the survey indicated a disconnect between what consumers say they want and what they’re willing to order and pay for. About 84 percent of respondents said “healthy dining options” are at least somewhat important to them when choosing where to dine out, which was about the same as the 86 percent who said the same last year.

However, this year only 20 percent said health options were “very” or “extremely” important, falling from 29 percent in last year’s survey. More than half — 52 percent — said nutrition information on menus has no impact on their ordering decisions, rising from 45 percent who said the same last year. And only 16 percent of this year’s respondents said they would be willing to pay a premium for certified organic food at restaurants.

The survey results also suggest that consumers are experiencing “promotion fatigue,” said Adam Werner, also managing director at AlixPartners and co-lead of the restaurant practice.

The number of consumers who said they plan to spend less at restaurants by using coupons, promotions and discounts dropped to 49 percent this year from 56 percent a year ago, and 60 percent in the 2012 survey.

“In recent years, consumers have been hit with just about every kind of ‘meal deal,’ ‘two-for-one deal,’ ‘limited-time-only deal,’ ‘not-really-a-holiday deal,’ etc. imaginable, and while many such promotions have been quite effective, they may well be less effective going forward,” Werner said. “Instead, our survey and in-field experience suggests that consumers today are showing a preference for everyday low pricing and consistent value.”

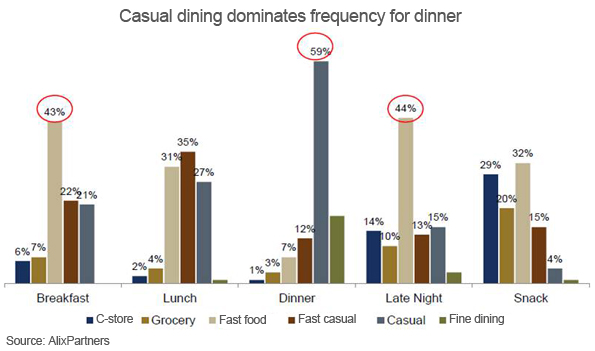

Meanwhile, lunch has become the fevered battleground for restaurants, the survey results indicate. Surveyed consumers prefer casual-dining restaurants for dinner and quick-service restaurants for breakfast. Lunch, however, is split among segments, with 35 percent of respondents preferring fast-casual options, 31 percent choosing quick service and 27 percent selecting casual dining.

However, grocery and convenience stores are increasingly cutting into the action. Survey respondents said grocery and convenience stores are the preferred breakfast source for 13 percent of consumers, 6 percent prefer them at lunch, 4 percent prefer them at dinner, 24 percent prefer them for late-night dining and 49 percent prefer them for snacks.

Contact Lisa Jennings at [email protected].

Follow her on Twitter: @livetodineout