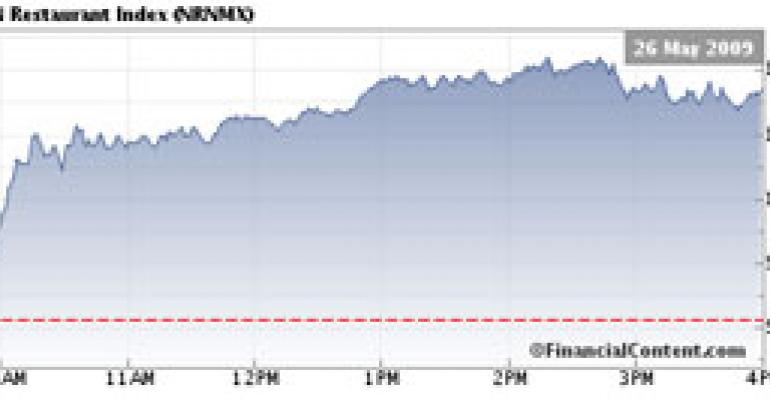

NEW YORK The Nation’s Restaurant News Stock Index posted on Tuesday one of its highest closing values this year on news that consumer confidence about the economy is on an upswing.

Besting the general market’s gains, which included a 2.4-percent increase for the Dow Jones Industrial Average, a 3.5-percent increase for the Nasdaq, and a 2.6-percent gain for the S&P 500 Index, the NRN Index jumped 3.8 percent on Tuesday to close at 1,018.41. So far this year, the NRN Index, which is a market-cap weighted listing of all public restaurant companies, has closed above 1,000 only nine times in more than 100 days of trading.

The stock market gains were sparked by news that The Conference Board Consumer Confidence Index for May rose to 54.9, up from 40.8 in April. While still depressed from year-ago levels, the index has jumped three months in a row from the February low of 25.3. The Conference Board, a private research firm, bases its Consumer Confidence Survey on a representative sample of 5,000 U.S. households. The May result was the highest in eight months and fueled mostly by a more optimistic view of future economic trends.

“Looking ahead, consumers are considerably less pessimistic than they were earlier this year, and expectations are that business conditions, the labor market and incomes will improve in the coming months,” Lynn Franco, director of The Conference Board consumer research center, said in a statement. “While confidence is still weak by historical standards, as far as consumers are concerned, the worst is now behind us.”

Evidence has been mounting that the restaurant industry may have already suffered the worst of the recession’s hits. If consumers become more confident, increased spending is typically not far behind. Various reports have shown that dining out is usually the first areas in which consumers feel comfortable spending again.

“Assuming the economy continues to stabilize and show further ‘green shoots’ of hope, we believe potential upside exists for restaurant industry same-store sales and earnings per share into late 2009,” Bob Derrington, a restaurant securities analyst at Morgan Keegan & Co., said in a report. “Ultimately, we believe those projected improving trends will jump-start restaurant stock price performance later this year and into 2010.”

Following Tuesday’s close, the NRN Index is nearly flat for the year, and down 15 percent from the same Tuesday a year ago.

Contact Sarah E. Lockyer at [email protected].