Unconfirmed indicators about sales in the casual-dining sector portray January results as glum, with same-store volumes falling 1.9 percent, versus year-earlier results for that month, when comparable-restaurant volumes rose 5.5 percent over January 2005’s same-store average for casual players.

Though market forces—especially the “trading-down” effect on budget-conscious consumers—recently have restrained the dinnerhouse industry overall, the estimated January decline is made no more attractive by the fact that the 5.5-percent jump a year earlier was 2006’s strongest monthly same-store surge for casual chains.

January 2007 also disappointed the sector by yielding an apparent 4.1-percent decline in guest counts, versus the year-before month’s traffic gain of 3.1 percent.

Both the same-store and guest count figures for the latest January are based on weekly data, and the final figures will depend largely on the specific weeks included in individual chain’s monthly results and the impact of an annual shift in the New Year.

However, it appears that January 2007 included one week of positive same-store results and three weeks of negative comparable sales for the casual-dining category, with negative guest counts being recorded in all four weeks—with the spread between the best and worst weeks of the month being a high 5.3 percent, pitting the strong first week against the weakest, the third.

January’s bitter, snowy weather was the biggest factor suppressing sales and traffic. I estimate that the industry lost 1.7 percentage points in same-store potential to big chills in several regions. That happened even though gift card sales were unusually strong—suggesting that even when consumers have cash equivalents burning holes in their pockets they don’t rush out to spend it in lousy weather.

In a heavy snowstorm a TV market can easily record a loss of 20 percent of sales in a given week—in some cases even higher. For example, Denver had very heavy snows in December, and the Denver “Area of Dominant Influence” TV marketing zone posted the lowest Knapp-Track result of any ADI for December 2006—down 9.7 percent from a year earlier, versus a decline of 2.3 percent for the prior 11-month period. That clearly reflects the sales-stunting power of poor weather.

By way of taking some small comfort in the 1.9-percent same-store sales dip for casual dining in January, we note that the overall retail industry posted an even more gloomy 4.0-percent monthly decline on a weighted-average basis, as measured by Bear Stearns analysts. They say that marked a shift from the pattern observed from April 2003 through December 2006, when retailers in general outperformed casual-dining chains on the same-store sales gauge. Over that 44-month period the only exceptions of the casual-dining sector topping general retail were November 2004, January 2005, April 2005, May 2005, January 2006 and March 2006.

For a majority of casual-dining concepts, value propositions will continue to be very important as inflation in general, and specifically increases in the costs of energy, education, medical care and drugs put substantial pressure on households earning under $50,000 a year.

There’s no denying that the basic economy is slowing. The federal government’s results for its current fiscal year show that first-quarter gross domestic product rose 5.6 percent, while the latest revised second-quarter GDP growth was a significantly lower 2.6 percent and the third quarter was up only 1.6 percent. The preliminary fourth-quarter GDP is up 3.5 percent, however.

The Manufacturing Index, as measured by the Institute for Supply Management, was 49.3 for January, down 2.1 index points from 51.4 in December. An index above 50.0 indicates an expansion of manufacturing activity. The average Manufacturing Index number for the past 12 months is 53.4. The basic good news in manufacturing is that export orders are still expanding, with a January index number of 52.5. Export orders have increased for 50 straight months.

The NonManufacturing Business Activity Index figure of the Institute for Supply Management rose 2.3 points to 59.0 for January, up from 56.7 in December. Services have been expanding since March 2003, a consecutive increase of 46 months.

The good news is that from December 2005 through December 2006, the number of jobs on America’s payrolls has increased by a revised 2.24 million, or an increase of 1.66 percent. The year 2006 was revised upward by 405,000 jobs on the new benchmarked base. December 2006 was revised upward by 933,000 jobs on a seasonally adjusted basis. That revision, a substantial change, provides a statistical anchor for helping restaurant sales increase in 2007 because the base of jobs is stronger than previously thought.

There are sharp differences in unemployment rates by race. For whites, the January unemployment rate was 4.1 percent while for Hispanic workers it was 5.7 percent, and for black workers the rate was 8.0 percent. The white unemployment rate rose 0.1 percentage points from December while the Hispanic unemployment rate increased 0.8 percentage points and the rate for blacks declined 0.4 percentage points from month to month.

Gasoline prices Feb. 5, 2007, were $2.191, down 6.45 percent, or 15.1 cents, from a year earlier. It’s likely that gasoline prices will rise because oil has moved up substantially from recent lows.

The record-setting level of $77.30 a barrel on the crude-oil futures markets last Aug. 7 was due to the closure of part of the Prudhoe Bay oil field in Alaska, operated by BP, due to corrosion in a pipeline system. But the futures market had settled down by Feb. 9 to a $59.89-per-barrel crude price, a drop of 22.52 percent, even though the recent cold weather increased demand for heating oil. Crude oil prices hit a 20-month low of $49.90 a barrel Jan. 18 and then jumped by 20.02 percent.

Experts expect the price of oil to return to a $65-a-barrel average throughout 2007.

The silver lining in the recent decline in comparable sales is that fundamental consumer demand remains strong, and when more disposable income becomes available to the under-$70,000 income group, its consumers are expected to flock back to casual-dining favorites.

Still, however, consumers’ emotional climate is not good, harming casual-dining sales.

The Iraq “surge” does not have wide support and the Iraq issue is still the largest one in the minds of voters. Meaningful improvement in the emotional climate depends largely on how events in Iraq play out, and that outcome remains a big unknown.

It was unhelpful that Lewis “Scooter” Libby was convicted on four of five counts for perjury and obstruction of justice because, as Dick Cheney’s top advisor, he was widely regarded as being among the four or five most powerful people in the White House, including the president and vice president. Other hearings on Capitol Hill will maintain a similar focus on questionable governmental actions.

I expect that casual-dining sector’s same-store sales will improve in 2007 from 2006 because of weak numbers in the prior year’s second, third and fourth quarters, as well as a reduced rate of unit growth for the segment, particularly in the bar-and-grill category. In addition, lower inflation would mean an improvement in real income versus total income growth, and casual-dining sales also would be aided by reasonably good employment numbers and a relative decline in durable-goods sales, both of which would free up money for restaurant purchases.

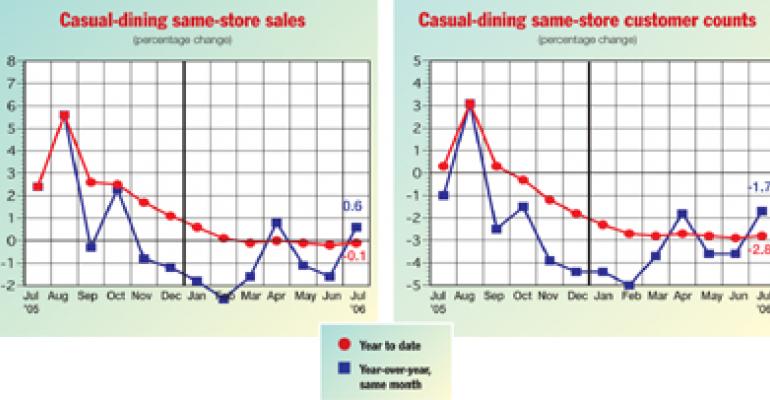

Final results for December show that same-store sales for the casual sector rose a scant 0.6 percent from the same month of 2005. That result was 1.8 percentage points worse than the on-trend same-store gain of 2.4 percent for December 2005, which was the fifth best month of that year. December’s same-store guest counts fell 1.7 percent, versus a 1-percent dip in that month a year earlier.

Casual dining’s guest counts overall for 2006 dipped 2.8 percent, compared with an increase of 0.3 percent in 2005.

Turning from same-store comparisons for casual dining, the sector’s all-restaurant sales for 2006 rose 6.1 percent, down from the 8.2-percent increase for 2005, and guest counts last year rose 3.6 percent, off from 2005’s 6.2-percent traffic gain.

The Consumer Confidence Index rose in January by 0.3 index points to 110.3, marking an increase of 3.5 index points from the level in January 2006.

The Present Situation Index increased 3.4 points to 133.9 index points for January, up 5.1 points from 12 months earlier.

January’s Expectations Index—how people thought the economy would perform in July 2007—fell by 1.8 points to 94.5—a minuscule increase of 2.4 index points from that index’s January 2006 level, when the Expectations Index was 36.7 index points below the then-current Present Situation Index.

By December the Present Situation Index still exceeded the Expectations Index by a whopping 39.4 index points.

Detailed January 2007 data show that consumer confidence was better in seven regions and worse in two—New England and South Atlantic—versus December levels. Six regions were above an index number of 100.0. The strongest Consumer Confidence Index in January was the Mountain region at 132.8, followed by Pacific, 128.3; West South Central, 128.0; South Atlantic, 120.2; East South Central, 113.0; West North Central, 112.9; New England, 93.9; Middle Atlantic, 90.8; and East North Central, 79.1.

The highest regional increase in an index number was 9.5 points for the West North Central region. The largest regional decrease was for the New England region, with a 4.1-index-point decline.

The largest spread between the Present Situation and Expectations indices was a negative 63.7 index points for the Mountain region. The highest Present Situation Index was 171.0, also for the Mountain region. The lowest regional Present Situation Index number was 77.6 for East North Central. The highest Expectations number was 113.5 for West South Central. The lowest Expectations figure was 80.1 for the East North region.

The unemployment rate in January was 4.6 percent, up 0.1 percentage points from December. Unemployment has been between 4.5 percent and 5.5 percent in each month since July 2004.

The total number of people working in nonfarm jobs in January was 137.3 million. There was an increase in January of 111,000 nonfarm jobs from December, marking the 40th month since September 2003 that employment has risen.

The initial jobs increase for December of 167,000 workers was revised up by 39,000 new positions to a final figure of 206,000 additional jobs. Prior total employment in the 21st century peaked in February 2001 at 132.6 million jobs.

Seasonally adjusted hourly earnings rose 3 cents in January to $17.09—a 4-percent increase versus January 2006. However, seasonally adjusted average weekly earnings fell 69 cents in January 2007 to $577.64. Seasonally adjusted average weekly earnings rose 4.02 percent from January 2006.

Total private, nonfarm weekly hours worked in January averaged 33.8 hours, down 0.1 hours from December. The manufacturing sector’s average weekly hours worked in January were 40.8, down 0.2 hours from December. Factory overtime at 4.1 hours was down 0.1 hours from month to month.

In December, eight of 11 Knapp-Track regions had positive same-store casual-dining sales. Three regions had negative results. Ten regions had better comparable-sales results in December than in October. One region—Mountain—had worse results in December than in November. The spread between the high and low regions for the sector’s same-store sales in December was 7.0 percentage points, versus the 3.9-point spread in November. The best-performing region was Pacific Northwest, followed by Middle Atlantic, New England, Texas, East North Central, South Atlantic and West North Central. Those seven regions had better or equal same-store sales than the national average of 0.6 percent for December. The worst performing region was a tie between Mountain and Florida followed by East and part of West South Central and California.

The highest region for comparable-sales results was Pacific Northwest and the lowest region was New England. The spread between those two was 3.8 percentage points. Median-concept comparable restaurant sales were unchanged.

With regard to December’s same-store results, the spread between sales and guest counts was a negative 2.3 percentage points. The national average for comparable-restaurant guest counts in December was down 1.7 percent. The best-performing region was Pacific Northwest, and the worst performing was Florida. Two regions—Pacific Northwest and Middle Atlantic—had positive same-store guest counts. Nine of 11 regions had negative guest counts, and the spread between the best and worst region was 6.5 percentage points.

Malcolm M. Knapp is president of Malcolm M. Knapp Inc. Knapp-Track™ is an exclusive report on the casual-theme and dinner-house segment, presented on a monthly basis. Based on actual, unpublished results received from key chains, Knapp-Track™ offers a realistic gauge of the segment’s performance. All percentage changes reflect nominal dollars.

The monthly same-store sales data are indicative of basic industry health, while the same-store customer traffic reflects the underlying strength of consumer demand.

Monthly all-store sales provide a benchmark against which the reported sales change of published quarterly reports can be measured; monthly all-store customer traffic is a proxy for real growth.

The year-to-date comparisons for all four categories provide perspective as the year unfolds, giving a fix on where the business is at any point in time.

Knapp-Track™ subscribers, representing more than $29.0 billion in sales, include Acapulco, Applebee’s, Benihana, Bennigan’s, Buca di Beppo, Chevys, Chili’s, Don Pablo’s, LongHorn Steakhouse, Lone Star Steakhouse & Saloon, The Olive Garden, On The Border, Outback Steak House, P.F. Chang’s, Pizzeria Uno, Red Lobster, Smokey Bones, Macaroni Grill, and T.G.I. Friday’s.