Restaurants posted their best month in eight years in December, as low gas prices, rising employment and weak comparisons resulted in a robust period for both traffic and sales, according to the latest NRN-MillerPulse survey.

According to the survey, same-store sales rose 4.6 percent during the month, giving operators an upbeat outlook heading into 2015.

“It was a good month,” said Larry Miller, cofounder of the index. “Better than what people thought it was going to be. And everybody was ready for a good month.”

Improvement during the month was felt across sectors, with both casual-dining chains and quick-service restaurants reporting strong same-store sales growth, of 4.4 percent and 4.6 percent, respectively.

The improvement came not just on price, but on new customers. Traffic rose 1.9 percent during the month, according to the survey, the best traffic number since March 2012. Quick-service traffic rose 1.3 percent, while traffic increased 2.2 percent for casual dining.

December was expected to be a good month for restaurants in part because comparisons are easy — restaurant sales were flat in December 2013, which was the weakest it has been since then.

But comparisons weren’t the only reason for the positive results. Miller said two-year trends improved in December. Had the comparisons been the primary reason for the improvement, those trends would have been stable, he said.

Restaurant sales improved steadily as the year went on. In the first half of the year, Miller said, restaurants’ average same-store sales growth was 1.4 percent. That improved to 2.8 percent in the second half of the year.

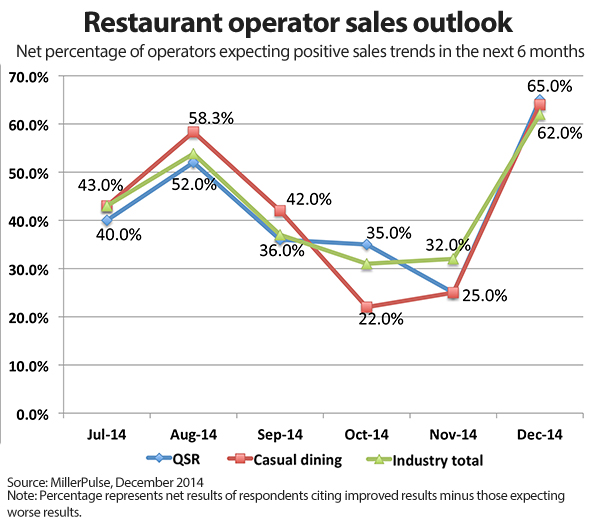

Sales also recovered remarkably from a surprisingly weak month in November, which Miller called an “aberration.” Sales improved 1.5 percent in November, but the December number beat that by 340 basis points.

Two big reasons for the sales improvement are gas prices and employment.

Gas prices have been falling to levels unseen since the recession. According to AAA, gas prices have fallen to $2.17 a gallon, the lowest rate since 2009. Gas prices have fallen for a record 102 straight days, and Americans saved $14 billion in gas prices in 2014.

At $2.17, gas prices are more than $1 below their level of a year ago. A person who uses 60 gallons of gas a month spends $68.34 a month less in gas than a year ago. That’s about the price a family of four might spend for a night out at a casual-dining restaurant.

The other reason for optimism is employment. U.S. employers added 252,000 jobs in December, and the unemployment rate fell to 5.6 percent. Overall, the economy added 2.95 million jobs in 2014 — the largest number of jobs added in a single year since 1999.

People are working, which gives them less time to make food and provides them an income to spend on eating out. They also have more money in their pockets because they’re not spending as much on gas — good reasons for restaurants to be optimistic in 2015.

“Gas prices have probably helped,” Miller said. “(Stock) markets are near all-time highs. The job markets continue to strengthen. All of that is good.”

Operators forecast a same-store sales gain of 2.6 percent in 2015. Quick-service operators expect 2.8-percent growth, while casual-dining operators say sales will grow 2 percent.

Miller says that it’s an “achievable target,” but it’s ahead of his own forecast of 2-percent same-store sales growth for the full year.

MillerPulse results are based on a monthly survey of operators averaging more than $40 billion in industry sales, representing all regions of the country and across the quick-service, casual-dining and fine-dining segments. Restaurant chains and operators interested in participating in the MillerPulse survey for additional results and insight can register at the MillerPulse website.

Contact Jonathan Maze at [email protected].

Follow him on Twitter: @jonathanmaze