This is part of the Nation’s Restaurant News annual Second 100 report, a proprietary ranking of restaurant brands Nos. 101-200 by U.S. systemwide sales and other data. This report is a companion to the Top 100 report.

This is part of the Nation’s Restaurant News annual Second 100 report, a proprietary ranking of restaurant brands Nos. 101-200 by U.S. systemwide sales and other data. This report is a companion to the Top 100 report.

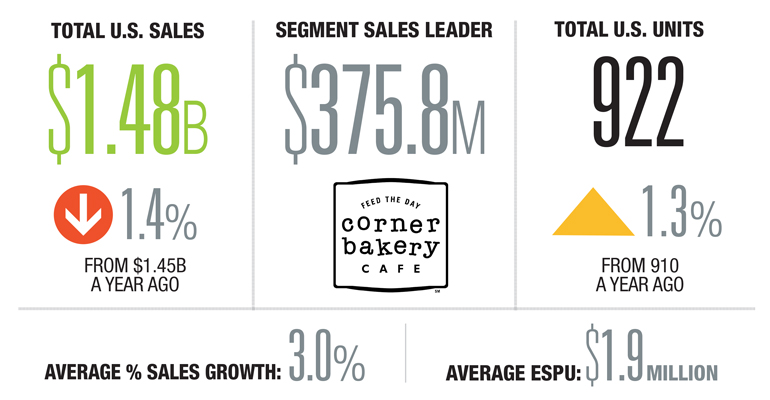

Sales and unit growth slowed in the Latest Year for the six Bakery-Cafe chains in the Second 100, as some of the largest operators in the segment saw flat performances.

The 3-percent average sales growth rate among Second 100 Bakery-Cafe chains — compared with 5.9 percent average growth for the Bakery-Cafe chains in the Top 100 — masked a stronger showing by some of the smaller chains. Those include Pret A Manger, which made its Second 100 debut this year as the No. 3 Bakery-Cafe chain, with $201 million in Latest-Year systemwide sales, a 14-percent

increase from a year earlier.

The London-based operator, which has a U.S. headquarters in New York, also outpaced the group with unit growth of 13.9 percent, to 74 U.S. locations, and growth in Estimated Sales Per Unit of 2.5 percent, to $2.9 million, the highest ESPU among segment operators.

The grab-and-go specialist benefited from strong breakfast sales, particularly coffee, the chain said in April. Pret A Manger also credited menu innovations such as hot brioche sandwiches and extensions to its Pret Pots line of snack-sized, nutrient-rich bowls.

The chain is also reportedly eyeing an IPO.

The two smallest Bakery-Cafe chains also notched systemwide sales and unit growth in the Latest Year. Le Pain Quotidien reported sales growth of 7.4 percent, to $174.7 million, and La Madeleine Country French Café saw systemwide sales climb 4 percent, to $174.6 million, despite a 3.4-percent drop in Estimated Sales Per Unit. Each added a handful of net new locations, with Le Pain Quotidien ending the Latest Year with 89 units, and La Madeleine with 87 locations.

The two largest chains in the segment saw systemwide sales slide in the Latest Year amid flat-to-declining unit counts and lower ESPUs and have been introducing new initiatives to reinvigorate their performances.

Segment leader Corner Bakery Cafe, which reported a sales dip of 1.4 percent, to $375.8 million, has been focusing its growth efforts in the Pacific Northwest, debuting in the states of Montana, Oregon and Washington as part of multiunit franchise agreements. The chain also introduced a new combo called “Choose Any Two” that lets customers mix and match menu items to create a meal.

No. 2 Au Bon Pain saw systemwide sales slip 3.1 percent, to $351.8 million, in the most recent year, as it continued to shift toward franchise openings. The chain maintained a steady 207-unit systemwide count.

The Boston-based brand recently implemented several initiatives to drive sales, including a new mobile order-ahead service called ABP Pickup. It also rolled out new menu line extensions, said Ray Blanchette, who completed his first full year as president and CEO in June.