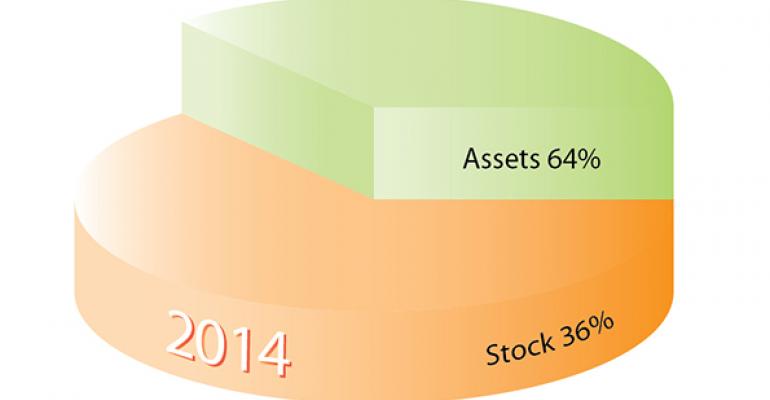

Restaurant merger and acquisition activity in 2014 was driven primarily by brand divestitures and refranchising, according to the latest Chain Merger & Acquisition Census from the J.H. Chapman Group LLC.

The industry saw 107 deals last year, a 10-percent increase over the previous year, as companies went public and restaurants sold franchisees and brands, according to the census. Prices for restaurants skyrocketed, as interest in the space grew and lending to restaurants became more aggressive.

In short, it was a seller’s market, but there were plenty of buyers. The mergers and acquisitions market is expected to remain active this year and into next year.

“I don’t see anything on the horizon causing a big blip,” said David Epstein, principal with J.H. Chapman. “The only thing that’s going to dampen this robust M&A activity is something that might happen globally, something that would interfere with business in general. But I don’t see anything unique” to the restaurant industry.

Private-equity groups were still interested in the restaurant space in 2014, but the number of deals involving equity funds fell to 22 percent, from 35 percent the previous year.

Part of the decline could be due to the robust market for initial public offerings. Eight companies announced plans for IPOs in 2014, the highest number of announced offerings since J.H. Chapman began its census in the 1980s, Epstein said.

Historically, restaurant chains would grow to a certain size and then be sold to a private-equity group that would invest in the concept and grow it further. But changes in federal law made the public markets available to smaller chains, and investors have welcomed them with open arms. For instance, Shake Shack Inc. went public in January with about 60 locations.

Smaller chains can get better prices by going public than they can by selling.

“What’s so interesting is that the IPO market in 2014 has not been particularly good,” Epstein said. “But in our industry, it has been good. The companies going public have brand recognition. That’s why the public likes them. The individual investor is attracted by those types of things, so it’s a good time for restaurant chains to think about that.”

Refranchising deals are also fueling much of the activity on the merger and acquisition market. More than half of all transactions involved sales of franchise units, according to the census, and many of those transactions were sales of corporate locations of chains like Wendy’s to franchisees.

Many of the deals are to existing operators simply looking to expand their business. They have access to lenders, which are aggressively pushing deals. They’re also pushing prices for these units higher, in part because many of the buyers already operate units within that brand and can spread general and administrative spending to more units. That enables them to make returns on those deals, even at higher acquisition prices.

Low-cost lending also enables buyers to pay higher prices.

“Values are higher now than we’ve seen in a long time on franchise stores,” Epstein said. “It’s a great time to be a seller of a franchisee.”

Indeed, in some cases existing franchisees are securing loans that enable them to pay up to 100 percent of the cost of an acquisition, Epstein said, because those operators had previously refinanced loans, paid off debt and built equity in their business.

In fact, Epstein said, it’s such a good market that those considering a sale of their business in the near future should do so sooner, while the market remains robust. He suggested that TGI Fridays’ refranchising plan is coming at just the right time.

Prices for struggling chains remain low

“Those considering selling, or who see a sale process in the not-too-distant future, should consider moving that up to 2015,” Epstein said. “The prices are going to stay attractive in 2015, and maybe into 2016. I would advise them to pull the trigger a little earlier.”

Refranchising deals aren’t the only types of divestitures that are fueling merger and acquisition activity. In some cases, restaurant companies are selling older brands in an effort to simplify their businesses.

Carlson, for instance, sold TGI Fridays to Sentinel Capital Partners and TriArtisan Capital Partners. Darden Restaurants Inc. sold Red Lobster to Golden Gate Capital. Other deals last year included Burger King Worldwide Inc.’s acquisition of Tim Hortons, the sale of Checkers/Rally’s to Sentinel, and the sale of Einstein Bros. Bagels to JAB Holding Co.

While the market remains robust and buyers are willing to pay high prices for acquisitions, prices for struggling chains remain low, as noted by the recent $8 million paid for Romano’s Macaroni Grill. Many potential buyers avoid such deals.

“They’re too much work,” Epstein said.

Instead, those deals tend to go to specialty investors, such as Food Management Partners, which bought the Furr’s Fresh Buffet chain last year.

“There are few companies around that want that type of thing, that can manage it and do it well,” Epstein said. “They’re patient in doing it. They have good lenders and they invest equity. It’s a specialty today.”

Contact Jonathan Maze at [email protected].

Follow him on Twitter: @jonathanmaze