McDonald’s Corp. has purchased a technology company that will automate the upselling of menu items in the same way Amazon suggests products to online shoppers.

The Chicago-based chain announced late Monday the purchase of Dynamic Yield Ltd., which specializes in personalization and decision logic technology. Terms of the deal were not disclosed but the Wall Street Journal, citing anonymous sources, said McDonald’s paid $300 million for the company, which has offices in New York and Tel Aviv, Israel.

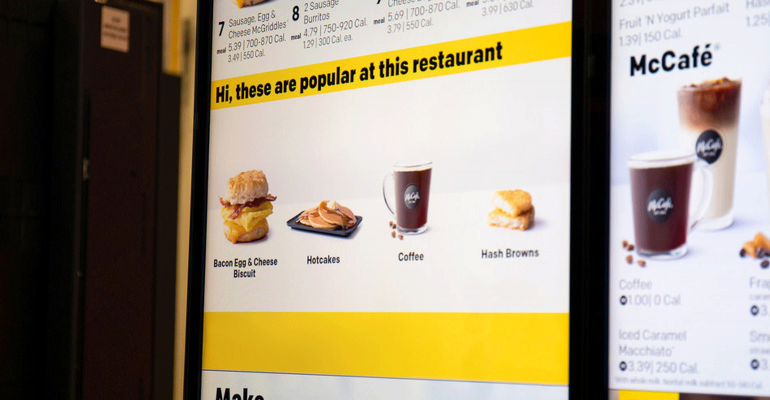

McDonald's said it tested the seven year-old Dynamic Yield’s AI-powered technology on several drive-thru menu boards in the U.S. last year. The digital menu boards offer a personalized customer experience, such as suggesting an add-on item to go with a customer’s current selections, McDonald’s said.

Menu boards can also show food items based on time of day, weather, current restaurant traffic and trending menu items at specific locations, McDonald’s said.

“This will enable McDonald's to be one of the first companies to integrate decision technology into the customer point of sale at a brick and mortar location,” the company said.

McDonald's plans to roll out the technology domestically this year, starting with drive-thru menu boards. International locations, self-ordering kiosks and the mobile app will adopt the technology later.

CEO Steve Easterbrook said the technology is critical to meeting the company’s goal of giving customers greater convenience on their terms.

"With this acquisition, we're expanding both our ability to increase the role technology and data will play in our future and the speed with which we'll be able to implement our vision of creating more personalized experiences for our customers,” Easterbrook said in a statement.

Industry analyst Tim Powell said McDonald’s is simply automating old-fashioned upselling, where cashiers are encouraged to suggest add-ons like fries or sodas.

“As long as this doesn’t add time to the ordering process, history has shown that patrons are inclined to add to their order if it’s applicable, convenient and reasonably priced,” said Powell, senior analyst and vice president of Q1 Consulting in Chicago. “In a lot of ways, it’s how we’re used to shopping online already – with Amazon.”

Testing technology aimed at boosting sales is important as the industry faces lackluster visits, he said. U.S. foodservice traffic has been stuck between a 1 percent gain and flat for several years now, according The NPD Group.

“Since traffic has been down, operators are looking to increase sales per store with existing counts. I’m interested to see how this technology will impact check averages,” Powell said.

McDonald's, which has 14,000 restaurants in the U.S., said Dynamic Yield will continue to look for new clients and work with its current ones, a roster of roughly 300 brands. According to the company’s website, it works with Sephora, IKEA, Urban Outfitters and HelloFresh.

The Wall Street Journal said the “last sizable” acquisition made by McDonald’s was in 1999 when it bought Boston Market for $173.5 million.

McDonald’s joins a growing list of QSR brands purchasing or investing large stakes in technologies to automate operations and simplify ordering for customers.

In December, Pizza Hut’s U.S. division acquired QuikOrder, an online ordering platform expected to improve the chain’s digital ordering capabilities.

More than a year ago, Pizza Hut’s parent company Yum Brands invested $200 million in Grubhub.

Contact Nancy Luna at [email protected]

Follow her on Twitter: @FastFoodMaven