Five years may not be enough time to move mountains, but it’s long enough for seismic shifts to occur in consumer tastes and dining-out habits, according to new data from The NPD Group.

In the past five years, gourmet coffee and tea purveyors have supplanted “other sandwich” chains, such as Arby’s, Chick-fil-A and Subway, as first in a list of the top 10 restaurant categories ranked by incremental traffic changes. Breaded chicken sandwiches have replaced large burgers as the best-performing entrée based on incremental servings change.

“The landscape has changed in terms of restaurant category growth,” said Bonnie Riggs, an analyst for NPD, a global market research firm based in Port Washington, N.Y. “To have made this list, there were big changes in visits.”

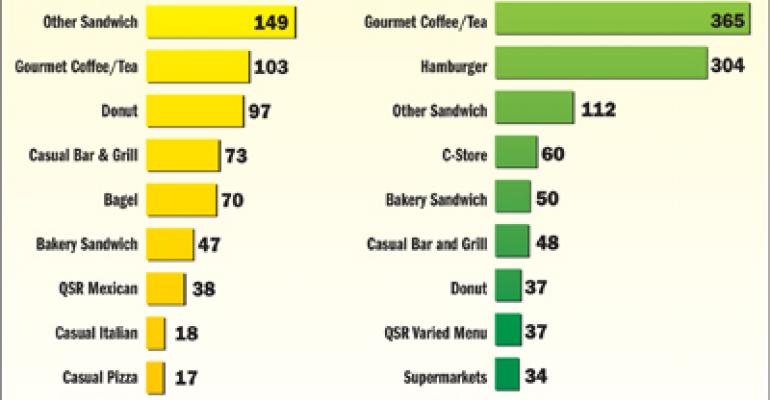

Specifically, for the year ended March 2007, gourmet coffee and tea purveyors took the top spot in a list of the top 10 restaurant categories based on incremental traffic change, followed by hamburger in second and other sandwich sellers, such as Arby’s, Chick-fil-A and Subway, in third. By comparison, for the year ended March 2003, other sandwich was the top restaurant category in terms of incremental traffic change, with gourmet coffee and tea in second, and donut purveyors in third.

Some categories had serious staying power and made both the 2003 and 2007 lists, while others joined the 2007 list for the first time. Gourmet coffee and tea, other sandwich, donut, bakery sandwich, and casual-dining bar and grill were the only categories to make the list in both 2003 and 2007. Convenience stores, supermarkets and discount stores were among the new categories on the 2007 list. And with traffic at retailers growing faster than traffic at restaurants from 2002 to 2007, according to NPD, some industry observers say retail is the segment to watch.

Although the gourmet coffee and tea category is at the top of the 2007 list, the hamburger category is the real winner, Riggs said. While gourmet coffee and tea had 365 million more visits in 2007 than the previous year, much of that growth was due largely to unit expansion, Riggs noted. Meanwhile, the hamburger segment had 304 million more visits in 2007 than in the prior year. With relatively little unit expansion in the category, hamburger’s growth could be attributed to real consumer demand, Riggs said.

Driving growth in the gourmet coffee and tea category is Seattle-based Starbucks Corp., which has grown dramatically since 2003. In the second quarter of fiscal 2007 the chain had approximately 13,700 stores in 40 countries, up from just 6,500 stores worldwide in the second quarter of fiscal 2003. During the same period, the coffee giant’s revenue grew from $954 million to $2.3 billion.

“We are always looking for opportunities to grow where our customers want us to be and expect to open approximately 10,000 new stores around the world in the next four years,” Starbucks spokeswoman Stacey Krum said.

Among the burger chains experiencing increased consumer demand is Carpinteria, Calif.-based CKE Restaurants’ Carl’s Jr. While the chain, which currently has more than 1,000 U.S. restaurants, hasn’t been growing dramatically in terms of units, it has reported positive same-store sales since 2001. In the year ended January 2007, same-store sales were up 4.9 percent and traffic was up about 1 percent over the previous year.

While convenience and value are still big attractions for time-strapped, price-conscious consumers, Brad Haley, executive vice president for the Hardee’s and Carl’s Jr. brands, thinks that what’s really driving them to Carl’s Jr. is the chain’s effort to elevate its menu quality to that of casual-dining restaurants.

“The quality of fast food has caught up with casual dining and still maintains the speed and value they can’t match,” he said.

Carl’s Jr. began chasing more upscale appetites in 2000 when it rolled out The Original Six Dollar Burger, a half-pound Angus beef burger. Since then, the chain has expanded the product line and now offers a total of six premium burgers.

Hamburger isn’t the only quick-service category performing well in terms of incremental traffic change. Nearly all of the top growth categories in the year ended March 2007 were quick-service categories. While four casual-dining categories were in the top 10 in 2003, only one—casual dining bar and grill—made the 2007 top 10 list.

“The shift in growth from 2003 to 2007 is strongly tied to QSR’s ability to meet convenience and price needs of consumers,” Riggs said. “Additionally, they have upgraded [their offerings] to meet consumers’ changing tastes.”

Those tastes are far different today than they were just five years ago. In the year ended March 2003, large burgers were the biggest entrée based on growth in incremental servings. Chicken was also big, with nuggets and strips coming in second, grilled chicken sandwiches in third, and breaded chicken sandwiches in fourth. Steak sandwiches ranked fifth, followed by main dish salads, quesadillas, breakfast wraps and burritos, nachos, and turkey/turkey clubs.

Five years later, breaded chicken sandwiches, now widely available from restaurants in the hamburger category, were the best-performing entrée based on incremental servings change. According to NPD, breaded chicken sandwiches had 256 million more servings in 2007 than the previous year.

Recognizing chicken’s popularity, many hamburger chains have introduced breaded chicken products. Among them are Wendy’s, which has added two breaded chicken sandwiches to its Super Value Menu in the past year; McDonald’s, which recently rolled out its new chicken Snack Wrap; and Burger King, which said it plans to add a spicy chicken sandwich to its value menu in the fall.

“No matter how you look at it—value, premium or snack—chicken is popular with consumers,” Riggs said.

Breakfast sandwiches and turkey/turkey club rounded out the top three performing entrées in 2007, NPD found. Burgers remained on the list, with the bacon cheeseburger in fourth and regular burger in eighth. Other top performers included bagels, muffins, steak sandwiches, bacon and scones.

When it comes to quenching their thirst, consumers’ beverage of choice has remained crystal clear over time. Bottled water topped both the 2003 and 2007 lists of the best-performing beverages based on incremental servings change. In 2007, bottled water had 205 million more servings than the previous year.

The other big beverage trend is the resurgence of traditional coffee, said Riggs. While hot regular and decaf coffee wasn’t on the list in 2003, it made its way to the No. 2 spot in 2007. According to the data, hot regular and decaf coffee had 160 million more servings in 2007 than in the previous year. NPD attributes this growth to the numerous chains that launched premium-coffee lines in the past few years, including McDonald’s, Burger King, and Dunkin’ Donuts.

Iced tea, noncarbonated soft drinks, and espresso-based beverages—including cappuccinos and lattes—rounded out the top five performing beverages for 2007.

Given record-high gas prices and other financial pressures, price and convenience are influencing consumers’ decisions about what they eat and where they purchase that food, Riggs said.

Even the growth in the casual-dining bar and grill category, which is largely tied to takeout and curbside service, can be attributed to convenience, she said.

Riggs points out, however, that the current economy alone might not be driving the popularity of convenient and less-expensive food. Instead, she suggested, consumer’s eating habits may be changing.

“[Maybe] they’re eating more often but smaller meals,” Riggs said.