PORTLAND Ore. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

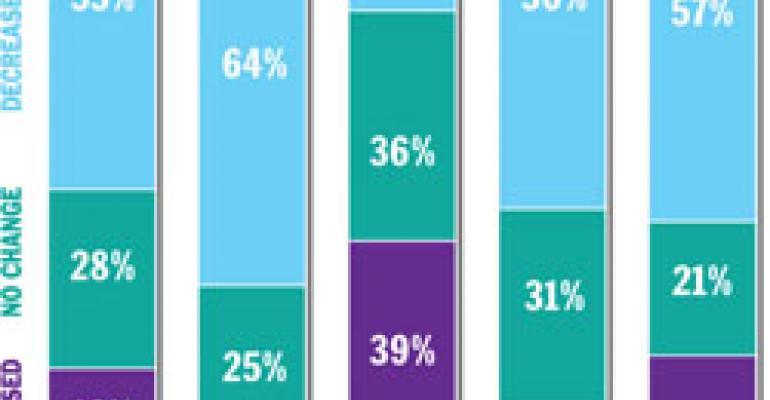

According to a new survey from the Council of Hotel and Restaurant Trainers, 53 percent of respondents said that their training budgets have been cut in the past 18 months. The results, which reflected answers collected from 140 CHART members in an online study, were reported in the 2009 State of Training and Development in the Hospitality Industry Report, which CHART released at its semi-annual conference here earlier this month. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

The survey results largely reflected the economic state of the industry segments responding, with casual dining reporting the biggest hit to training budgets. Sixty-four percent of respondents in the casual-dining sector said their budgets had been cut during the past 18 months. Other hard-hit sectors included upscale restaurants, with 56 percent of respondents from that sector saying their training budgets had fallen, and hotels, with 57 percent saying the same. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

Quick-service restaurants, which have tended to weather the recession better than pricier eateries as people trade down, also fared better in the budget-cutting arena. Only 26 percent of respondents said their training budgets had been cut, while 39 percent reported their budgets had increased. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

The results make sense, as quick-service employees need to be ready to handle the influx of price-conscious customers, said CHART president John Isbell. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

“If you are QSR, you have to make sure your folks are ready for that,” said Isbell, who is also executive director of training for Glendale, Calif.-based IHOP, a chain of more than 1,300 family-dining restaurants. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

Columbus, Ohio-based White Castle Systems Inc., which owns 418 White Castle restaurants, is among the quick-service companies that has increased its training budget, said John Kelley, senior director of training and team member services for the fast-food chain. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

“We had a little bit of an increase last year,” he said. “Usually, what you hear is that training is the first thing that gets cut, but the leadership in quick service knows it’s about the customer experience. I think what we are seeing is a shifting of resources.” —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

The CHART survey showed all participants’ companies spent on average a total of $1.9 million annually on training, including salaries, benefits, travel and in-house development of training materials. Within industry segments, quick-service and fast-casual restaurants spent an average of $3.1 million; casual dining, $1.9 million; and fine dining, $2 million. Hotels, which tend to have smaller training departments, spent less than $500,000 a year on average. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

The survey was created to give members a barometer of training spending and methods in the industry, Isbell said. Over time, the organization will be able to track changes in training practices. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

CHART is a nonprofit professional organization with more than 700 members from more than 400 multiunit restaurant and hotel companies. A total of 140 CHART members participated in the online study, which was conducted by Maritz Research, a Fenton, Mo.-based research and consulting firm. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

“It does mirror what we’re going through as a nation as far as cutbacks and the amount of time and money people are spending on training,” said Joleen Goronkin, a former past president of CHART who now consults on human resources and training through her Chanhassen, Minn.-based firm, People and Performance Strategies. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

CHART members said they have noticed that companies are making cuts across the board and that training departments are not the only ones trimming budgets as consumer spending and traffic slow. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

“Everyone in every department is going through significant cutbacks,” Goronkin said. “It’s about reduction in staff in all areas: finance, accounting, marketing.” —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

Goronkin is the former chief executive of the Elliot Leadership Institute, a nonprofit management development organization that suspended its services late last year because of the economy. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

“At ELI, we made the decision to go dormant based on the financial situation of the people we serve and the organizations we serve,” she said. “Sponsorship is just too difficult right now for companies cutting back in support center staff and restaurants.” —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

Travel and staff positions are most often what get cut out of training budgets, Isbell said. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

“Where there used to be two in a department, now there is one,” he said. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

However, the spending cuts in training do not necessarily mean operators are less committed to it, CHART members said. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

“Companies that maintain their focus on people are doing well,” Isbell said. “There may be limited dollars to spend, so they are harping on service and focusing training on giving the guests everything they need.” —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

Customer service and a welcoming environment are important to drive customer traffic in the current environment, and that’s where training needs to be focused, said Rick Garlick, senior director of strategic consulting for Maritz. He presented the survey to more than 130 attendees at CHART’s conference, which was held at the Hilton Portland hotel. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

“You are not just training staff about policies and procedures, but how to create a unique customer experience and make people feel like I want to come back here,” Garlick said. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

Many of the survey participants had positive feelings about their companies and efforts to provide good customer service despite the cuts to training budgets. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.

When asked in the survey how much they agreed with the statement “Our company is recognized for providing excellent customer service,” nearly 40 percent strongly agreed. In addition, 23 percent said they would invest their own money in their company. —Slashed training budgets have become another sign of the recessionary times, forcing operators to direct their diminished funds better to the customer service protocols that will set them apart in the brutally competitive environment.