With overall ad spending this year by national restaurant chains basically flat, quick-service operators are diversifying their spending on more narrowly targeted buys by devoting a larger percentage of their budgets to spot TV than do casual-dining chains, according to TNS Media Intelligence.

Restaurant ad spending rose 0.8 percent during the first half of 2007, compared with the same period last year, reaching $2.68 billion. Spending is estimated to reach $4.83 billion by the end of this year, which would be a jump of 1.5 percent over 2006, said John Swallen, senior vice president of research for New York-based TNS.

That modest increase is characteristic of a “fairly mature category,” and the restaurant industry happens to be one, he said.

An analysis on ad trends in various industries that Swallen recently presented to the Television Advertising Bureau shows this year’s estimated year-to-year spending increase by restaurants is far lower than in previous years. Spending was up 4.4 percent in 2006, 5.8 percent in 2005 and 5.9 percent in 2004.

Much of the advertising has focused on new products, new store concepts, and health and nutrition.

“The restaurant category must continually reinvent itself in terms of developing new menu items, new store concepts, something to keep the experience fresh in order to keep customers coming back again and again,” Swallen said.

Not surprisingly, TV continues to be the cornerstone of restaurant advertising, Swallen said. Quick-service chains will spend an estimated 82.6 percent of their ad budgets on national and spot TV this year, and casual-dining chains are expected to allocate 79 percent of their budgets to those categories.

What surprised Swallen as he analyzed restaurant ad spending was the percentage of the budgets that quick-service and casual-dining chains set aside for spot and national buys.

Each industry category allocates about 80 cents on the dollar to TV, he said, but of that 80 cents quick-service chains spend 55 cents on national TV and 25 cents on local, and casual-dining chains spend 65 cents on national and 15 cents on local buys.

“It may have something to do with the absolute size of the ad budget,” Swallen said.

National quick-service chains have larger budgets than casual-dining chains, allowing quick-service restaurants to diversify their spending to reach more narrowly defined targets, he said.

“At some point you come to a barrier of diminishing returns,” Swallen said. “You won’t get more returns by spending more money on national advertising.”

By spending proportionately more on local markets than the casual-dining chains do, quick-service restaurants can target consumers more effectively by ethnicity and lifestyle or concentrate advertising in markets with a large number of units, he said.

McDonald’, for example, spent about 21 percent of its budget on spot markets from January to May of this year. Wendy’s spent about 14 percent and Burger King only 3 percent.

Among casual-dining chains, Outback Steakhouse spent 14.2 percent on TV spots, and Olive Garden devoted 6.6 percent to local TV markets.

Although overall ad spending has been flat in the industry, some chains have increased their budgets aggressively, Swallen said. From January to May, Subway increased its budget by 21.3 percent, McDonald’s by 7.2 percent and Taco Bell by 6.2 percent.

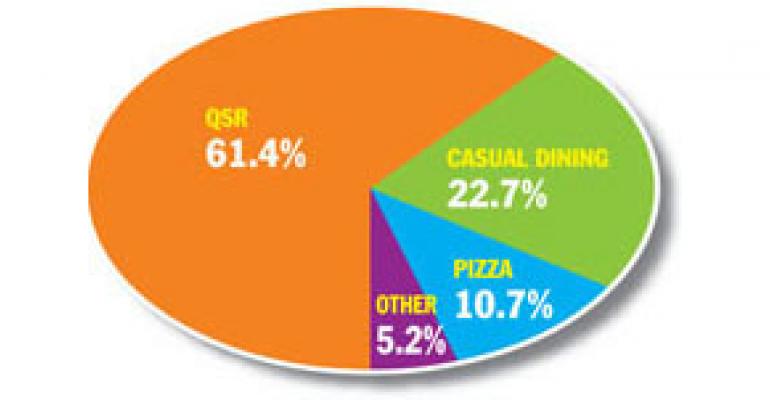

In 2006, quick-service sandwich chains accounted for 61.4 percent of all ad spending among restaurants. Casual-dining chains accounted for 22.7 percent, pizza chains for 10.7 percent and other restaurant concepts for 5.2 percent.

Spending for radio ads is holding steady. Estimated spending this year will account for 9.4 percent of the ad budgets of quick-service chains and 11.2 percent of casual-dining chains’ budgets.

Despite the proliferation of new-media options, Swallen said, restaurants are not doing a wholesale shift of media spending to the Internet, mobile phones or other devices because restaurants remain a mass marketer, and TV is a mass medium.

“Migrations to new alternatives are more likely happening with products targeted at key, select demographics,” he said. “Any migration to new options is happening on a piecemeal basis, not across the board.”

Traditional advertising still is a “significant chunk of money,” Swallen said, despite the belief that it’s headed to the graveyard.

“The coffin keeps getting bigger and bigger as they stuff more money into it,” he said.