Operators looking to penetrate the huge Los Angeles market need to understand that small chains and independents rule the terrain, as do consumers with a fondness for healthful food choices and Mexican fare, say officials with market research firm The NPD Group.

With slightly more than 34,000 restaurants, or 6 percent of all U.S. restaurants, Los Angeles is the country’s second-largest restaurant market in terms of number of units, according to NPD’s Spring 2007 ReCount database. Only New York ranks higher, with nearly 45,000 units, or 8 percent of all U.S. restaurants. Chicago ranks a distant third with about 18,000 restaurants, or 3 percent of all U.S. restaurants.

“[Los Angeles is] a big restaurant market,” said Bonnie Riggs, an analyst with Port Washington, N.Y.-based NPD. “If you’re looking to open or expand in L.A.…you need to know what the competitive landscape looks like.”

Unlike much of the country, where major quick-service chains dominate the landscape, in Los Angeles small chains and independents collectively account for a much greater share of units. According to the Spring 2007 ReCount database, major quick-service chains accounted for 47 percent of all quick-service units in the United States, but only 38 percent in Los Angeles. In comparison, small quick-service chains accounted for 33 percent of units in Los Angeles and only 23 percent in the total United States. QSR independents accounted for 31 percent of quick-service units in the total United States and 29 percent in Los Angeles. NPD defines independents as one or two units, small chains as three to 499 units and major chains as 500 or more units.

When it comes to table-service restaurants, full-service independents accounted for the majority of restaurants both in Los Angeles and nationally. According to the ReCount data, about 80 percent of full-service restaurants in both Los Angeles and the total United States were independents.

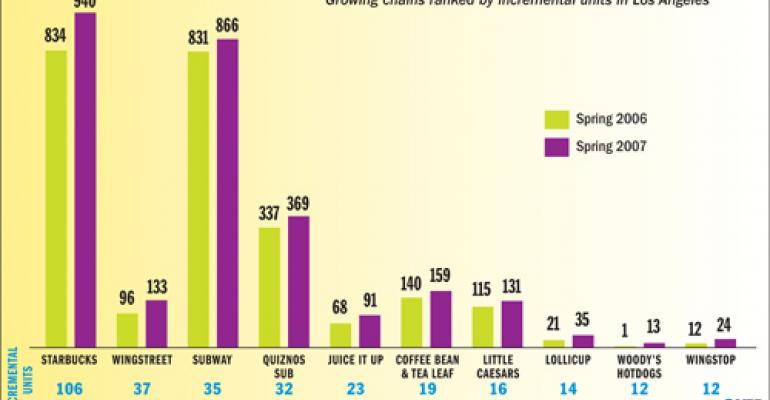

Yet despite the proliferation of small chains and independent restaurants in Los Angeles, some of the city’s biggest growth concepts are major chains. The top-growing concept in Los Angeles is Starbucks, which added 106 units from spring 2006 to spring 2007, according to the ReCount database. Other top growers include Wing Street, which added 37 units during the same period; Subway, which added 35 units; and Quiznos, which added 32 units.

“Major chains—whether full-service or quick-service—do not dominate this market,” Riggs said. “It has to do with the population and it could also be real estate—the cost for a chain to build a restaurant in this market.”

San Diego-based Rockin’ Baja Lobster, a full-service Mexican-style seafood chain, opened its first Los Angeles-area unit in January.

“For us as a brand, the biggest challenge…is finding affordable real estate,” said Houston Striggow, vice president of operations for Alexandria, Va.-based Fransmart, which four years ago partnered with Rockin’ Baja Lobster to help the brand grow. “A lot of big chains don’t come here because it’s too costly.”

One way the seven-unit chain has overcome the challenge of entering the costly Los Angeles market is by converting vacant restaurants to its concept instead of building from scratch, Striggow said. While the Los Angeles market is ripe for Rockin’ Baja, according to Striggow, the chain’s expansion is driven largely by the availability of conversion locations. He said Rockin’ Baja hopes to open additional units in Los Angeles in the next year, but only if the appropriate locations become available.

While Los Angeles may be home to many rich and famous residents, consumers in the low- to mid-income range tend to be the heaviest users of the city’s restaurants. According to NPD’s CREST Local Market data, for the year ended December 2006, 51 percent of visits to Los Angeles restaurants came from customers with annual household incomes under $59,999 and 49 percent came from households with annual incomes of $60,000 or more.

The city’s heavy restaurant users may not have a lot of disposable income, but they do have their youth. For the year ended December 2006, those under age 34 made 55 percent of visits to Los Angeles restaurants, according to NPD CREST data.

Restaurants in Los Angeles also depend greatly on traffic from the local Hispanic and Asian populations. For the year ended December 2006, NPD found that 76 percent of traffic at Los Angeles restaurants came from white consumers, 8 percent came from black consumers and 16 percent came from “other groups,” a category in which Hispanics and Asians figure prominently.

By comparison, data collected from the country’s top 39 restaurant markets, a list which includes such cities as New York, Chicago, San Francisco, Dallas, Denver and Miami, found that nationwide 79 percent of traffic came from white consumers, 13 percent came from black consumers and 9 percent came from other groups.

When Los Angelenos dine out, they seek out hamburgers, pizza/Italian or Mexican fare from quick-service restaurants and Asian and Mexican fare at full-service restaurants, NPD Spring 2007 Recount data showed. That is not too different from data collected from all 39 top markets, which found pizza/Italian quick-service restaurants to be the most developed category, followed by hamburgers and subs. For full-service dining, Asian, bar and grill, and family style topped the list.

The fact that Mexican restaurants rank higher in Los Angeles is a notable difference, Riggs said. She also noted that the city has 3,626 Asian casual-dining restaurants and only 3,004 hamburger restaurants, according to the NPD Spring 2007 ReCount database.

“One of the key things is there are more casual-dining Asian restaurants [in Los Angeles] than there are hamburger restaurants,” Riggs said. “You hardly ever see that.”

Quick-service consumers in Los Angeles are more likely than average to visit quick-service restaurants for healthful choices, special occasions or because they want a hearty or a light meal. The city’s full-service consumers are more likely than average to visit full-service restaurants because their kids like it there, for healthful choices, as a treat or reward, or for special occasions.

Los Angeles diners’ penchant for healthful choices is a major driver for Seattle-based Organic to Go, a 17-unit all-natural cafe and corporate meal delivery service that dishes out a variety of organic soups, salads and entrées. In the past two and a half years the small chain has opened 10 units in Los Angeles and Orange County.

“[Los Angeles has a lot of] men and women who are looking for delicious food…guilt-free,” said Jason Brown, chief executive of Organic to Go. “It’s just a great geographic region for expansion for a company like us.”

Los Angeles diners also prefer Mexican food. In the year ended December 2006, the percentage of orders that included Mexican foods was above average in the Los Angeles market when compared with the top 39 markets, according to NPD CREST data. L.A. diners were more likely than those in other top markets to order Mexican foods, including refried beans, burritos, enchiladas, grilled chicken and tacos. They were less likely than those in other top markets to order such comfort foods as baked potatoes, bagels, breakfast sandwiches and roast beef sandwiches.

“Foods in L.A. trend right along with the market,” Riggs said. “These are the things operators [in Los Angeles] should put on their menus, even if they’re not a Mexican restaurant.” n