The instant pay movement has found support from the industry's largest franchise operator, Flynn Restaurant Group.

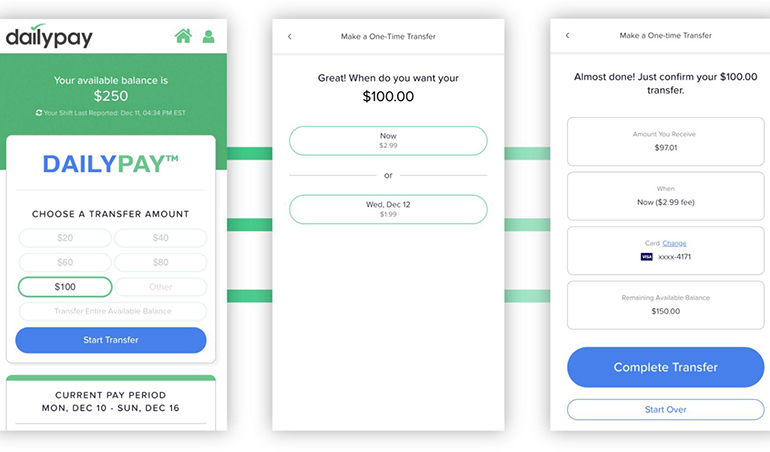

The San Francisco-based restaurant company, which operates more than 1,200 Taco Bell, Applebee’s, Arby's and Panera Bread franchise locations, is offering DailyPay to about 47,000 employees. At that size, Flynn has become DailyPay’s largest restaurant industry client. The third-party payment company’s app allows employees instant access to their earnings.

Other restaurant clients of the New York-based company include Los Angeles-based cupcake chain Sprinkles Cupcakes and franchise operators of Burger King, Taco Bell and Boston Market.

After initial testing, Flynn began rolling out the software at Applebee’s locations two months ago, Betsy Mercado, vice president of human resources at Flynn, told Nation’s Restaurant News. All 460 restaurants now have the software.

Mercado said the company plans to phase in the instant pay system to its other brands in the following order: Panera Bread, Arby’s and Taco Bell. She said the company is introducing the perk to show employees how “deeply” Flynn values them.

The company hopes to benefit, as well.

Flynn is hoping the perk will help attract employees and shrink labor turnover at each brand. The turnover rate for hourly employees is 88% at Applebee’s and 95% at Panera Bread. The quick-service brands, Arby’s and Taco Bell, have much higher rates, hovering just above 200%.

That’s well above the industry median, which is about 145%.

Mercado said it is too early to calculate any impact from DailyPay. However, the company will “absolutely measure” the perk’s effect on turnover, she added.

To date, she said about 20% to 25% of Applebee’s employees are actively using the app.

DailyPay officials say that’s a good participation rate for only being available two months at Applebee’s. Adoption rate among DailyPay clients, on average, ranges from 30% to 35%.

Workers pay a money transfer fee that ranges between $1.99 to $2.99.

Mercado said employees using the service, so far, have provided positive feedback. They are accessing their earnings ahead of payday to pay for basic expenses like a family meal or groceries when they are short on cash, she said.

Roughly 78% of U.S. workers live paycheck to paycheck with 20% missing monthly payments on the smallest of bills, according to the latest research by employment website CareerBuilder.

Many retailers and restaurants are adding financial wellness tools, which often include instant pay services, to help employees struggling to pay bills before their next paycheck.

In late September, fast-casual chain Noodles & Company began offering app-based financial tool, Even, to 10,000 employees.

Besides giving employees access to their daily earnings, Even, which is used by Walmart, offers budgeting tools so workers can set aside funds in a savings account.

Since deploying the financial wellness tool, Noodles said 20.35% of employees have logged into the app. Of those, 51.92% have taken advantage of instant pay. Nearly 520 employees using the app have saved a total of $40,926, collectively.

Contact Nancy Luna at [email protected]

Follow her on Twitter: @fastfoodmaven