Content Spotlight

Tech Tracker: How digital tech is capitalizing on the hot restaurant reservations market

Tock and Google now offer experience reservations; Diibs launches as a platform for bidding on last-minute reservations

The pizza chain evolved from near bankruptcy into one of the most advanced companies in the restaurant business

![]()

Domino's Pizza has revolutionized the way the restaurant industry thinks of technology. Photo: Domino's

Domino's Pizza has revolutionized the way the restaurant industry thinks of technology. Photo: Domino's

A few years ago, as consumers were quickly replacing flip phones with smartphones, Domino’s Pizza CEO Patrick Doyle charged his company’s IT team with this request:

Make it so a customer could order a pizza while waiting for a stoplight.

Think about this for a second. There are 34 million potential combinations of pizza on the Domino’s menu. Maybe some customers order a large pepperoni. But there are others who might go through the menu and order a spinach and provolone pizza with barbecue sauce.

How could an app enable customers to wade through all those selections in the 17 seconds it takes, on average, for the light to turn green?

The answer to this question goes a long way toward explaining how Domino’s became the most technologically adept chain in the restaurant business — one that has revolutionized the way concepts think of technology and its potential to bring in business.

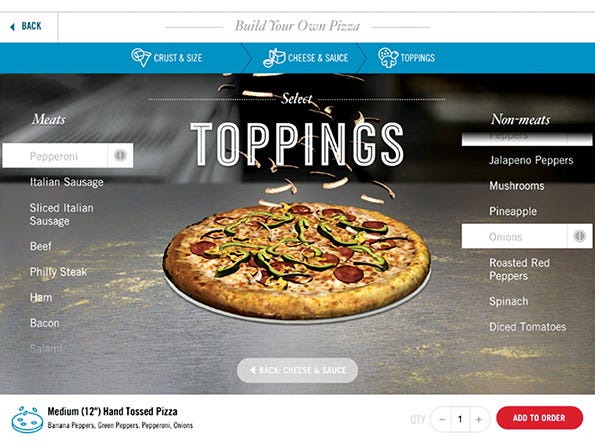

Domino's customers are now more likely to order from a digital platform, such as the chain's iPad app above, than they are to order via phone. Photo: Domino's

Domino's customers are now more likely to order from a digital platform, such as the chain's iPad app above, than they are to order via phone. Photo: Domino's

Customers can now order on an app, by voice, by sending a pizza emoji over social media, or through their television.

Domino's has backed these efforts with an unprecedented marketing campaign aimed at the ease of ordering. Customers are now more likely to order from one of these digital platforms than they are to order via phone. And they’ve done so in droves: Company sales and franchisee profits have surged.

Domino's is an old dog that taught itself a bunch of new tricks.

The seemingly tired, old, pizza delivery chain became a major e-commerce retailer in just a few short years, one that operates as much like Amazon as it does Papa John’s. The ease has helped Domino’s fit in nicely with a culture populated with smartphones where precious seconds matter — even if those seconds are spent at a stoplight.

It’s difficult to overstate how far Domino’s has come as a company.

Between 2006 and 2008, same-store sales at Domino's domestic locations fell a cumulative 10 percent. Over that period, revenues dropped from $1.5 billion to $1.4 billion. The company had $1.7 billion in debt. And the worst of the recession hadn’t even started.

The company was shedding franchisees, and the number of domestic locations in 2008 fell by more than 100, to just over 5,000 locations. The company’s stock fell below $3 a share in November 2008.

The company then introduced several new products and famously changed its pizza recipe the next year, and sales began to grow. Same-store sales have risen in each of the past seven years, including 12 percent last year. Franchisees are more profitable, and the stock is up — way up.

If you’d been lucky enough to purchase $1,000 in Domino's shares that November in 2008, you’d have nearly $52,000 right now.

By comparison, investors who bought $1,000 worth of Chipotle Mexican Grill stock in November 2008 and then sold it at peak last August before its recent $300 freefall, would have had nearly $20,000.

Ease of ordering has helped the company generate consistent sales growth. “The technology portion is a significant part of their sales driver,” said Peter Saleh, analyst with financial services firm BTIG.

“You can order on your watch, order on your phone, however you feel comfortable ordering it,” Saleh said.

“Those are playing a major role in their sales growth and market share gains.”

Kevin Vasconi, who has been Domino’s chief information officer since 2012, said that the company’s product quality remains the most important element of its improvement.

“It does seem like technology recently has been the driver,” he said. “But a lot of groundwork was laid before we doubled down on technology. We have a great product and a really good value, and if we didn’t have those things, the technology story wouldn’t be nearly as big.”

Domino's CIO Kevin Vasconi said the chain's marketing department supports its tech initiatives. Photo: Domino's

Domino's CIO Kevin Vasconi said the chain's marketing department supports its tech initiatives. Photo: Domino'sDomino's builds technology platforms like Lego bricks.

Kelly Garcia, Domino’s vice president for e-commerce development, likens the company’s technology efforts to a series of Lego bricks. Every platform and every system, he says, is built to adapt to future uses.

“When you’re thinking from a technology perspective, you can’t guess the experiences they want,” Garcia said.

The first such brick was laid many years ago, in 2002, five years before Steve Jobs introduced the iPhone and eight years before Doyle was promoted to CEO.

That was when Domino’s started converting company-owned units to its own point-of-sale system, called Pulse. The company then required franchisees to convert to this system by 2008.

How did Domino's secure franchisee buy-in?

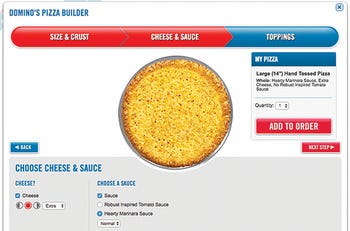

By going with a single point-of-sale system, Domino’s can build e-commerce or food-ordering platforms more easily.

By going with a single point-of-sale system, Domino's can build e-commerce or food-ordering platforms more easily.The decision was controversial — franchisees wanted to shop around for a system, sued the chain and ultimately lost. At the same time, however, Domino’s made the system more efficient and less costly, assuaging some of the operators’ concerns.

Bringing franchisees and company-owned units onto the same POS system would prove remarkably prescient. “It was maybe the most important technology decision made in the last decade at Domino’s,” Vasconi said.

By going with a single point-of-sale system, Domino’s can build e-commerce or food-ordering platforms while only worrying about that single system. It doesn’t have to manage multiple vendors or systems with different technologies.

The single system speeds the process and enables the company to do things more quickly.

“That is the original, fundamental piece,” Garcia said. “If you don’t have the same POS system, you’re writing software that, at a minimum, must interface with software across different sets of technology. That’s been a huge piece for us.”

Domino’s also brought the technology in house, so it can control the system and not work through a vendor. Working in house speeds the process because when Domino’s wants to add new functionality, it simply does it, rather than contract through a vendor.

These in-house efforts enabled the company to add a loyalty program more quickly last year than it would have been able to do so otherwise, Garcia said. “It was easy for us because we managed the POS system,” he said. “We were able to do it very quickly for the size and scale of that project.”

Domino’s was able to add its Tracker function to the mobile and online sites. “It wasn’t hard to do,” Vasconi said, noting that the POS system already tracks the status of orders.

The chain works failure into the game plan.

Any innovative company that works quickly to add functionality to its processes needs to understand that failure is part of the business.

“Not everything goes perfect here,” Garcia said.

Domino’s has instead built a “fail fast” business culture. Risk taking is encouraged. But so is testing and analyzing early in the process to see if an idea works — or doesn’t — early in the process.

“We’re going to try a lot of things,” Vasconi said. “And we’re going to work really, really hard to figure out as soon as possible whether that project has legs and whether we should take it to the next phase.”

That testing takes numerous forms, and demonstrates in part how Domino’s is different from many of its restaurant industry competitors.

Yes, the company has many traditional testing methods.

“We build a lot of prototypes,” Vasconi said. And it tests ideas in its company-owned locations to see how customers will respond.

Domino's likes to experiment with new technology, such as this delivery car with warming oven introduced last fall. Photo: Domino's

Domino's likes to experiment with new technology, such as this delivery car with warming oven introduced last fall. Photo: Domino'sBut it also has a team of data scientists who gather customer data, mostly from the company’s online and mobile app but also from its POS system, to analyze results and determine if an idea will work.

“We have an absolutely unbelievably talented data scientist team that does research and analysis on concepts with consumer-based techniques to understand what would happen if we go down a path,” Garcia said.

“They test it out with user groups or with various statistical methods to give you an idea of the likelihood of success.”

The company also employs A/B testing, a strategy used primarily by large e-commerce and web firms like Amazon. In short, it compares two versions of a web page to determine which one works better, then steers a percentage of traffic to the changed site.

It then gathers data from the two sets of customers to see how they interacted with the new page.

“We very much are testing in real production ideas that people may or may not think are good ideas,” Garcia said. The testing “takes the emotion out of it. We let the data speak.”

See how Domino's solves the stoplight challenge:

The Easy Order allows customers to order from a Ford car, over a Samsung smart TV, via text message, or through an emoji sent to the Domino’s Twitter account. Photo: Domino's

The Easy Order allows customers to order from a Ford car, over a Samsung smart TV, via text message, or through an emoji sent to the Domino's Twitter account. Photo: Domino'sGarcia still remembers the day, three years ago, when he and the company’s chief digital officer, Dennis Maloney, were driving from the Denver airport to the company’s ad agency.

They began brainstorming ideas for answering the stoplight problem: How to enable customers to make an order in just a few clicks.

The solution was The Easy Order.

Give existing customers the ability to save an order they get most frequently. That would enable those customers to make a repeat order quickly, potentially in the time it takes to wait at a stoplight.

Customers can order through a smartwatch app. Photo: Domino's

Customers can order through a smartwatch app. Photo: Domino'sThe Easy Order is a perfect example of how Domino’s technology operates like a Lego brick, Garcia said.

The Easy Order made ordering easy, but it also provided the base for so many other capabilities.

Over a period of several months in 2014 and 2015, the company unleashed a series of new methods for customers to order pizzas from Domino’s. It gave customers the ability to order from a Ford car, over a Samsung smart TV, from a smart watch, via text message, or through an emoji sent to the Domino’s Twitter account.

This from a company that already had a healthy online ordering presence and a mobile app with voice ordering capabilities.

More than half of Domino’s marketing spending focuses on digital efforts. Photo: Domino's

More than half of Domino's marketing spending focuses on digital efforts. Photo: Domino'sEasy Order enabled much of this expansion. “At the time, it had nothing to do with watches or TVs or cars or any of the rest of the stuff,” Garcia said. “But it became a foundational item that allowed us to very quickly, with what were relatively low cost investments, to provide different experiences on top of it.”

The ease of ordering is a key reason that more than half of orders at Domino’s now come through digital channels — a percentage Garcia expects to grow.

Speed isn’t Domino’s only game, Vasconi noted. The company’s Internet and mobile presence is also designed for entertainment, to help customers navigate the menu in a fun way, and then to help them keep track of their pizza process.

“We want that to be the best experience, whether you’re ordering for a party or you’re at work,” Vasconi said. “It should be a really rich, graphical experience with lots of description, a totally different way of ordering.”

Domino's supports technology from the top.

It’s one thing to have the functionality. But both Vasconi and Garcia said that support from marketing has been important. After all, what’s the point of having all these cool new systems if you’re not going to tell customers they exist?

“Having the marketing department be one of our biggest cheerleaders and proponents is incredible,” Vasconi said. “It’s something that doesn’t happen at every company.”

Domino’s has effectively advertised these capabilities as they have come along. More than half of the company’s marketing spending now focuses on the chain’s digital efforts, which buttresses its ease-of-ordering bonafides with consumers.

“The stuff on the fringe is a good way to build a brand,” Saleh said. “It shows you can access [Domino’s] wherever you are.”

Support at the company doesn’t just come from marketing.

There is a strong belief at the company, starting from CEO Doyle on down, that technology is a game changer. That belief dates back years.

“That’s why I took the job,” said Vasconi, who came to Domino’s from Stanley Black & Decker four years ago. “What a great opportunity as a technologist to work for a company where the CEO is already convinced that technology can change the business.

“[Doyle] saw the capabilities. He doesn’t know how all the ones and zeroes work, but he saw the vision, he knew how technology can supercharge this business.”

The recent technology innovations are also a recruiting tool to get people to work in the IT department.

Four years ago, Vasconi struggled to get people to work for the company. It’s much easier now. “I used to spend a far larger amount of time just selling people on the company,” he said.

Of course, it helps that the company is doing some interesting things. And everybody likes pizza.

“Pizza is fun,” Garcia said. “If you’re an IT professional, you’re in a candy store.”

Contact Jonathan Maze at [email protected]

Follow him on Twitter: @jonathanmaze

You May Also Like