Casual-dining chains that succeeded in this challenging climate of time-pressed customers found ways to convince guests that their venues were worth taking the time to slow down to enjoy great food, drinks or service.

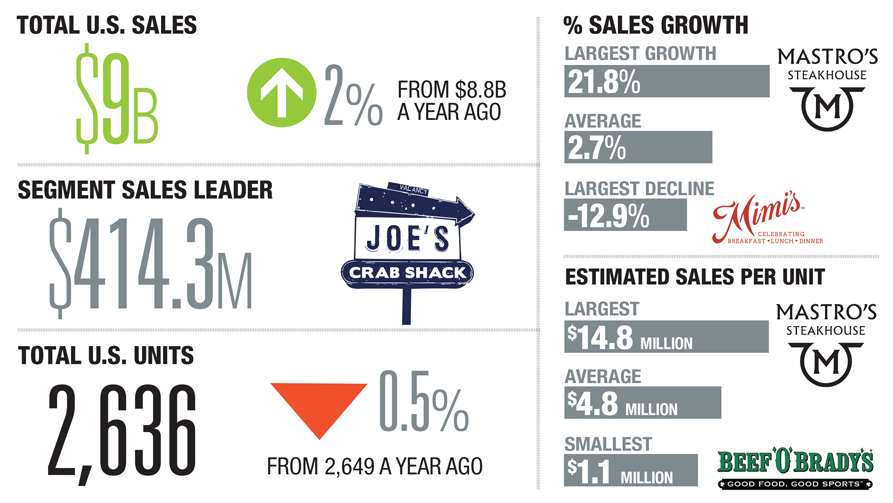

The 36-chain Casual-Dining segment underperformed against all but one other Second 100 segment, with 2.7 percent average growth in annual systemwide sales.

The tiny Buffet/Grill-Buffet segment, stymied by restaurant closures, is the only segment that performed worse than Casual Dining, with an average decline in system sales of 13.8 percent.

The average sales growth among all of the Second 100 chains was 5.2 percent.

But there were high points within the Casual-Dining segment. Bar Louie saw U.S. systemwide sales grow by 11.7 percent, owing largely to 16 new units opening over the course of the Latest Year, giving it a total of 108 units.

CEO John Neitzel said the chain was able to grow by appealing to customers looking for a local experience.

Bar Louie researched its customer base and found that, although 96 percent also used other casual-dining restaurants, on occasions when they considered visiting Bar Louie, most customers were choosing between Bar Louie and independent operators.

“When they’re looking for more of a social, experiential experience, they’re looking for something different [from a chain],” he said, adding that the average guest experience in his restaurants is two hours and 15 minutes.

Neitzel said they accomplish that by making sure each Bar Louie looks a bit different from the others.

“There are consistent elements — furniture, lighting, photography — but we challenge ourselves to be different at each one,” he said.

Beer and liquor selections, which make up a little more than half of Bar Louie’s total sales, are also localized, with general managers given freedom to choose about 18 of the 30 beer taps, and to select local spirits as well.

Old Chicago Pizza & Taproom, which hangs its hat on its craft beer program, takes a similar, but even more aggressive, approach, with beer offerings changing every three to six days.

The 102-unit chain, which added a net five locations in the Latest Year, has 11 craft beer specialists who, according to president Mike Mrlik, are devoted to developing relationships with local brewers so they can bring limited releases and proprietary brews to each location.

“At any given time we have more than 550 beers available [systemwide],” he said.

He’s also working on adding more cicerones — the beer world’s equivalent of a sommelier — to his system.

“Our goal is to get 30 certified cicerones by the end of 2018,” he said.

Old Chicago also evolved the menu in 2016 — something it does every six months — with new bone-in and boneless chicken wings, customizable mac & cheese, and a new pizza crust made with ale that is now ordered in 14 percent of the chain’s pizzas.

Some steakhouses also performed well, especially at the high end, such as Mastro’s and Del Frisco’s Double Eagle Steakhouse, both of which are small enough and have high enough estimated sales per unit — over $14 million each — that adding one restaurant was enough to put them in the top 10 in the segment in terms of domestic sales growth.

Larger steakhouse chains Fleming’s Prime Steakhouse & Wine Bar, Morton’s the Steakhouse and The Capital Grille held their own with less than 2 percent growth in sales, although Morton’s closed a unit and Capital Grille opened one.

Other Casual-Dining chains with good growth in the Latest Year distinguished themselves in other ways such as Fogo de Chão with its distinctive food and service style of a Brazilian churrascaria, and Seasons 52 with its tempered health message and strong seasonal one. Publicly traded Chuy’s managed to open a net 10 units in the Latest Year, giving it a total of 69 — a jump of about 17 percent that matched its increase in sales.

Contact Bret Thorn at [email protected]

Follow him on Twitter: @foodwriterdiary