The Yum Brands Inc. board of directors has approved the separation of Yum China, the company said Monday, paving the way for the deal to be finalized by Oct. 31.

Yum! Brands and its investors hope that the deal paves the way for more growth for both companies that will emerge from the spinoff.

“We are moving full steam ahead with the separation of Yum China, establishing two powerful, independent and focused growth companies dedicated to building on our brand strengths and unlocking the full value of each business for our shareholders,” Yum! Brands CEO Greg Creed said in a statement.

Yum! Brands, the Louisville, Ky.-based operator of KFC, Taco Bell and Pizza Hut, is splitting off its China business, which is primarily company owned. The rest of Yum! Brands is mostly franchised.

Although franchising generates higher profit margins, operating restaurants generates more revenue and more dollar profit. As Yum! Brands’ growth in China has taken off, the company has become more dependent on the country for sales and profits.

At the same time, however, as growth has stalled in recent years, it has dampened expansion at Yum! Brands overall.

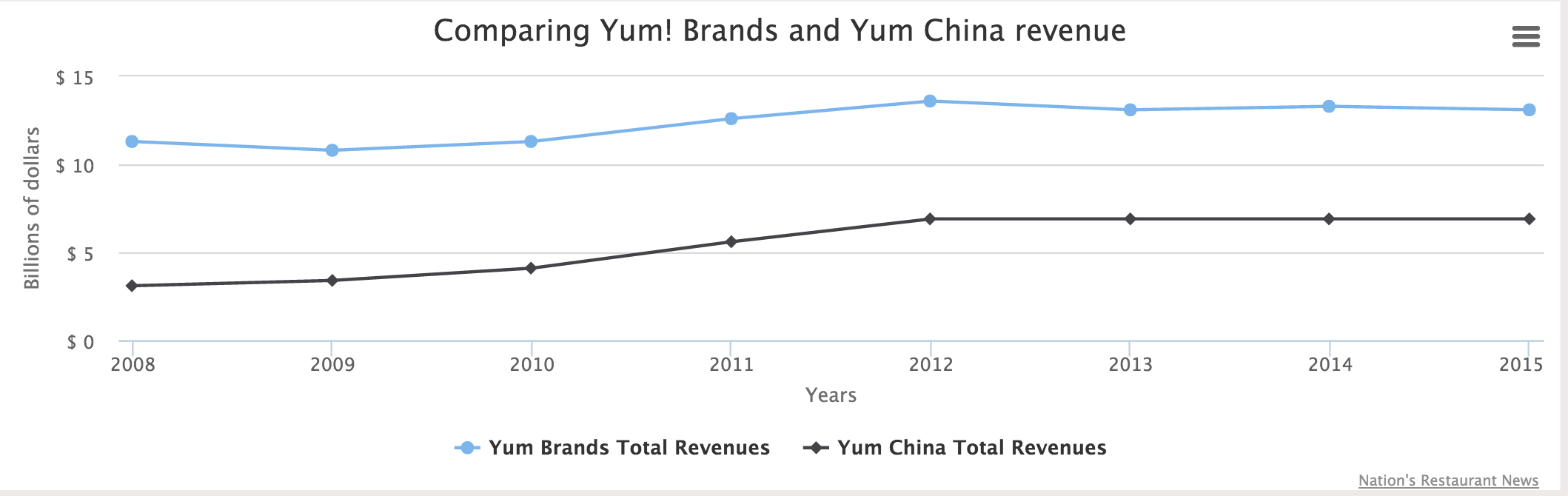

Consider this: In 2008, Yum! Brands generated $3.1 billion in revenue. By 2012, revenue more than doubled, to $6.9 billion, or an additional $3.8 billion.

That accounted for all of Yum! Brands’ total revenue growth over the period. Yum! Brands’ total revenue rose $2.3 billion, to $13.6 billion, meaning that revenue outside China actually fell over that period.

But a pair of food safety crises in China, along with bird flu fears and economic malaise, led to steep declines in same-store sales in the country. Although Yum! Brands kept building restaurants, revenue growth stalled, reaching $6.9 billion in 2015, the same as in 2012.

Unsurprisingly, Yum! Brands’ overall revenue growth fell in that time by $500 million, to $13.1 billion, by 2015.

By spinning off Yum China, the company says it can focus on the higher-margin franchise business, while enabling the new China company to concentrate on restaurant operations and growth.

“Yum China has a leading position in the China market, and we see tremendous opportunities to leverage our well-recognized brands and decades of experience to drive growth,” Micky Pant, CEO of Yum China, said in a statement.

The company says Yum China still has plenty of room to grow because China has plenty of room to grow.

In an SEC filing last week, Yum China Holdings Inc. said it should be able to continue increasing the number of KFC and Pizza Hut units — and, eventually, Taco Bell — in the country because of the likelihood of prolonged economic growth there.

Yum China has 7,200 restaurants in the country — it had just 3,000 units there in 2008 — and net income of $323 million in 2015. The company said the number of middle-class and affluent households in China should grow from 116 million people in 2016 to 315 million by 2030.

Meanwhile, more middle-class households will be in the central part of the country, where economic growth has been slower to reach than it has on the coasts. The percent of middle-class Chinese living in the central part of the country is expected to grow from 13 percent in 2002 to 39 percent in 2022.

Sara Senatore, an analyst with Bernstein Research, suggested that a stabilizing economy in China and improving sales and profits at KFC and Pizza Hut there should help the company generate 15-percent earnings growth every year. Senatore also said Yum China can still add units, as economics on new restaurants continue to improve.

“China still appears to have room to grow,” Senatore wrote in a note last week.

Yum! Brands, looking to get more local ownership and digital expertise for Yum China, will sell a portion of Yum China to a pair of investors: Primavera Capital Group and Ant Financial Group are investing $460 million in the China unit. On Nov. 1, Yum China will start trading on the New York Stock Exchange under the ticker symbol “YUMC.”

Contact Jonathan Maze at [email protected]

Follow him on Twitter: @jonathanmaze