Content Spotlight

Tech Tracker: How digital tech is capitalizing on the hot restaurant reservations market

Tock and Google now offer experience reservations; Diibs launches as a platform for bidding on last-minute reservations

Voices from around the restaurant industry

How sale leasebacks can unlock capital that is tied up in the real estate.

May 28, 2024

While many restaurant operators have invested in technology and automation to support the post-pandemic rebound by increasing efficiency and addressing staffing challenges due to soaring labor costs, higher interest rates and tighter lending regulations have created challenges for restaurant and foodservice operators to access the capital they need to fund these initiatives.

A ready source of capital that operators can consider is a sale leaseback of the restaurant properties they own. A sale leaseback is essentially the sale of owned property to an investor and the simultaneous leasing back of that same property from the new owner under a long-term lease. This transaction effectively unlocks capital that is tied up in the real estate. This capital can then be deployed to drive growth with investments in equipment and technology, new locations, the hiring of skilled staff, or used to reduce debt.

Nuances of sale leasebacks

Many restaurant and foodservice operators may be familiar with sale leasebacks but are less informed about their nuances and advantages.

One misconception about sale leasebacks is a perceived loss of control over the property. In reality, sale leaseback transactions are negotiated under a long-term lease. This long-term lease component offers restaurant operators a similar level of control as if they still owned the property. A typical sale leaseback term generally spans 15 years or longer, with optional renewals extending for an additional 20 years or more at the tenant’s discretion, providing effective control for at least 35-40 years.

Restaurant operators can also utilize several levers to optimize sale leaseback structure and value. These include the lease structure itself, where to set the base rent, as well as the percentage and frequency of rent increases. Further, restaurant owners can negotiate change of control provisions, providing the optionality to pursue an eventual exit or sale of the business.

For restaurant owners considering a sale leaseback, it’s important to understand that, at their core, sale leasebacks are a credit-driven transaction. The buyer of the property is looking for a long (and uninterrupted) stream of rental income. As a result, sale leaseback investors conduct standard credit analysis to determine the seller’s ability to service lease payments over the course of the lease.

The emphasis on credit serves to de-emphasize the importance of location, as compared to a traditional real estate transaction, where it is a primary factor. Stable cash flows from the restaurant company at large can hold equal importance to the location of a single location or multiple locations, even if they are in less desirable areas.

Sale leasebacks in the restaurant industry

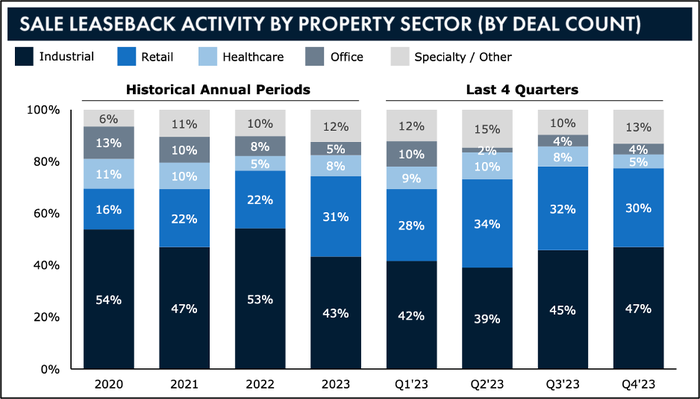

Sale leaseback transactions in the retail industry have rebounded since the pandemic. A number of restaurants have executed sale leaseback transactions to raise capital or pay down debt over the past few years.

Over the last 12 months, in three separate tranches, Red Robin has raised $84 million by selling and leasing back 27 of its properties. Proceeds from the sale leasebacks were used to repay debt and fund capital investments and support repurchasing shares of company stock.

Last year, Missouri-based Chicken N Pickle, a family entertainment complex with restaurants and pickleball courts, raised capital for growth and expansion by selling five of its locations and leasing them back.

In late 2022, Taco Bell raised north of $18 million in a sale leaseback on a 7-property portfolio of assets based in Ohio.

Source: SLB Capital Advisors

Providing opportunities in the high interest rate environment

A sale leaseback is generally always below a company’s weighted average cost of capital and therefore makes sense to consider. The increase in traditional debt financing rates that have occurred over the last 18-24 months makes the sale leaseback an even more attractive financing solution, given it prices below many companies’ cost of traditional debt. Although cap rates rose in the past year, sale leaseback financing remained ~200 basis points below bank and high-yield debt. And though many are hoping that the Fed will soon cut interest rates, which could lower the cost of capital for traditional debt financing, the strong labor market and persistent inflation make the “higher for longer” scenario a possibility.

The restaurant industry requires owners/operators to use all resources at their disposal to continue to be competitive. Monetizing owned facilities can provide a cost-efficient source of capital to help them continue to grow.

AUTHOR BIO

Stephen Cheng is a partner at SLB Capital Advisors. Stephen has more than 18 years of experience in the real estate markets, including execution of sale leasebacks, capital raising, joint ventures and M&A. Stephen was most recently a Director at Stan Johnson Company, previously Executive Director of Real Estate Investment Banking at Oppenheimer & Co and started his real estate career at RBC Capital Markets where he rose to be a Vice President in Real Estate Investment Banking