The improving U.S. economy has helped restaurants see healthier sales, but better economic times can be a double-edged sword for brands when it comes to recruiting and retaining employees.

Hiring talent will become harder and more expensive this year, according to experts at the Global Best Practices Conference in January, which is sponsored by Dallas-based analytics firm TDn2K.

“We didn’t have the good sales and traffic that we would have liked over the last four or five years, but on the other hand it was relatively easy on the people side,” said Victor Fernandez, TDn2K’s executive director of insights and knowledge.

“The question has shifted now. We’re seeing better traffic and positive sales, which the economy is pushing forward in 2015,” he said, “but that means on the flip side that it continues to be harder to get the people equation right.”

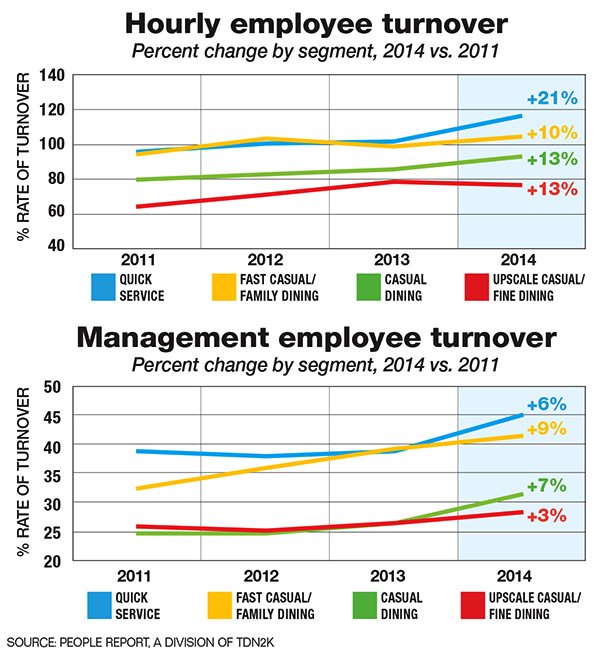

Restaurants are seeing increased turnover in both the hourly and management ranks as other sectors of the economy increase their hiring, Fernandez said.

The U.S. unemployment rate has been lower than 6 percent in each month since September, with the economy adding 321,000 net new jobs in November and 252,000 in December.

Other industry statistics reflect TDn2K’s data and projections. The National Restaurant Association, in its 2015 economic forecast, said the restaurant industry in 2014 added 1,000 jobs per day. “The overall restaurant industry is projected to provide a record 14 million jobs in 2015,” the NRA forecast noted.

“There are so many more jobs being created throughout the economy,” Fernandez said. “In 2014, more jobs were created than in any other year since the late ’90s.”

That hiring level across the economy is also putting pressure on restaurant wages.

“We have not been good in terms of wage growth in recent years,” Fernandez said. “The industry has felt there was no need to accelerate wage growth because of all the available talent out there. That has changed.”

As hiring increased, businesses found the labor force participation rate dipped. Between 2000 and 2014, the labor force participation rate fell 12 percent among those 16 to 24 years old, Fernandez said.

Economist Joel Naroff, president of Naroff Economic Advisors, a retained economist at TDn2K, noted that the labor force participation rate for men has been falling since World War II. While that decline was offset until 2000 by the increasing rate of women in the workforce, that participation for females has been declining.

The restaurant industry’s prime hourly employee is in the 16-to-24-year-old age range, a demographic group the NRA noted “currently comprises about four in 10 restaurant workers.” The Bureau of Labor Statistics, the NRA said, expects the number of 16-to-24-year olds in the U.S. labor force to decline by nearly 3 million between 2012 and 2022.

“The Great Recession and its aftermath had a significant impact on the U.S. labor force,” the NRA forecast said. “The labor force participation rate fell to a 35-year low, with many people who lost jobs deciding not to return to the workforce. Contributing to this decline was the retire of baby boomer, as well as a growing proportion of teenagers choosing to remain on the sidelines.”

The decline in the teenage labor pool has been significant for the restaurant industry, the NRA said. “In 2007, 16- to 19-year-olds represented 20.9 percent of the restaurant workforce,” the forecast said. “By 2013, these teens made up only 16.5 percent of restaurant employees.”

Fernandez said that because fewer teens are electing to take hourly restaurant jobs, “there are fewer employees available.” He theorized the recession was slow and painful for the younger demographic that had difficulty finding jobs.

“Many just decided not to work anymore,” Fernandez said. “You hear stories of them going back to live with parents or getting part-time jobs; others are going back to school or boosting resumes with volunteering.”

Differences among demographic groups

(Continued from page 1)

He noted that companies in the year 2000 that had 100 potential candidates ages 16 to 24 now have just 88 candidates in that range.

“That’s 12 fewer people you have available to attract to your restaurants,” Fernandez said. “Add to that competition from other sectors, and you have fewer potential workers available for restaurants.”

The drop in Millennial workforce participation has also led to a growing age gap between hourly workers and management employees, Fernandez noted.

The median age of new hourly hires in quick-service restaurants is now 21 years old, and the media age of new management hires is 30 years old, a gap of nine years. The chasm is even larger in casual dining, with the median age of hourly hires in 2014 reported at 22 years old, while the media age of new management hires was 37 years old, a gap of 15 years.

What those two age demographics expect from companies in terms of pay, time off and culture can be very different.

“Rewards and benefits differ between the two,” Fernandez noted.

Flexibility in scheduling, for example, is important to younger workers. “Many are juggling several part-time jobs, so they want the flexibility to choose shifts,” he said.

New technology in scheduling software, often on smartphones, helps companies provide that flexibility. “That’s a great tool to make flexibility happen,” he said.

Global Best Practices conference panelists said wages alone aren’t motivating high-achieving Millennial workers.

“High achievers want more than a paycheck,” said Lloyd Hill, a board member of Red Robin Gourmet Burgers Inc. and past chairman of Applebee’s Neighborhood Grill & Bar. “They want to have a purpose.”

Hill said companies are seeking new ways to provide programs that benefit the community, such as local charities.

“You have younger workers now who don’t care as much about the health benefits and any other long-term incentives,” Fernandez said. “The other group is looking more toward a career and might have a family, so incentives for attracting and retaining them is a different mindset.”

It’s not just about pay and benefits calculations. High rates of turnover in either group of workers can also affect sales, Fernandez noted.

“To get the repeat customer, you want that tenured manager who is engaged and making a good customer experience happen,” he said.

“It’s hard to have that consistent performance if you have a revolving door at the management level,” Fernandez said. “Traffic is the biggest problem for the restaurant industry right now, so inexperienced frontline hourly employees have to be especially well-trained.”

Contact Ron Ruggless at [email protected].

Follow him on Twitter: @RonRuggless