Restaurants will be among the strongest performers in a U.S. franchising industry that overall is expected to see slightly lower rates of growth in sales, number of units and employees hired in 2013, according to new research.

Quick-service and table-service restaurant systems with franchisees were included in the “Franchise Business Economic Outlook for 2013” report released Thursday by the International Franchise Association Educational Foundation.

RELATED

• IFA survey: Failure to extend tax rates could hurt franchises

• Burger King franchisee to acquire 97 units in Mexico

• More restaurant industry franchising news

“While we are pleased the [franchise] industry continues growing at a faster rate than other sectors of the economy, we could be growing much faster and creating more new jobs and businesses if Washington addressed the tax, spending and regulatory uncertainty plaguing the small business community,” Steve Caldeira, president and chief executive of Washington, D.C.-based IFA, said Thursday during a conference call with reporters.

IHS Global Insight handled the research and analysis for the report. Analysts there anticipate franchising industry sales from all types of businesses will grow by 4.3 percent in 2013, to $802.38 billion, marking a deceleration from estimated 2012 sales growth of 4.9 percent.

IHS analysts said the quick-service restaurant segment is one of just three franchise business categories, out of 10 in all, expected to see higher rates of sales growth in 2013. For the segment, they forecasted a 5.2-percent increase in sales next year, to $206.50 billion, versus estimated improvement of 5.1 percent this year. Commercial and residential services and retail food are the other two franchise business categories with accelerating sales growth, the analysts indicated.

Quick-service segment leads the way

Setting the scene for the slower growth in franchise activity overall in 2013, IHS is forecasting a macroeconomic environment with higher taxes on upper income earners and cuts in government spending resulting from the pending political resolution to the looming “fiscal cliff.” Analysts said that resolution may ease some uncertainty about the economy among consumers and businesses but still would act as a “drag on growth” that cannot be fully countered by such “grounds for optimism” as the improving credit situation and rebounding housing and automotive sales.

Referring to the minor gain in sales growth in 2013 forecasted for franchised quick-service restaurants, the researchers noted, “The meager improvement we do anticipate on the economic front will bring back some of those battered customers who abandoned even lower-cost restaurants.”

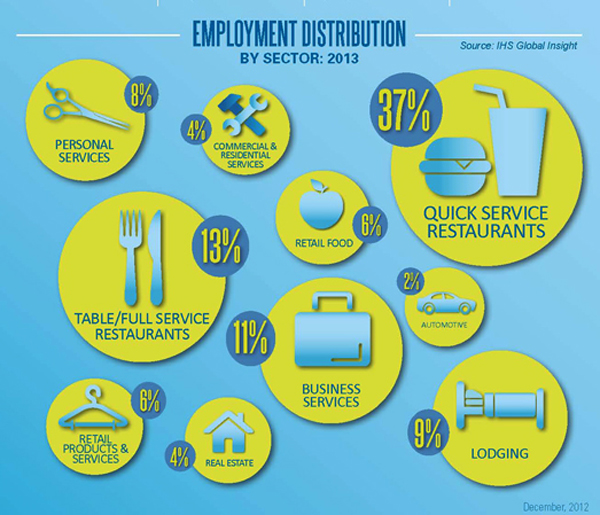

Quick-service restaurants make up the largest of the 10 franchise-industry categories covered in the IFA forecast for 2013, with 25.7 percent of the all-category sales, 20.3 percent of the establishments and 37.3 percent of the employees.

Table-service restaurant systems that franchise are expected to see 4.5-percent growth in sales in 2013, to $59.93 billion, compared with stronger estimated growth of 7.0 percent this year, IHS said.

The IHS analysts said they believe sales growth will slow at all table-service restaurants in 2013, including franchised locations, because of the anticipated higher taxes on the upper income households and lower increases in business travel that helps drive full-service restaurant traffic.

IHS is forecasting that quick-service restaurant systems that franchise will see their combined number of establishments grow by 1.7 percent in 2013, to 153,425, compared with 2.0-percent growth in 2012. The aggregate number of establishments in table-service systems that franchise will increase by 1.0 percent, to 36,436, in 2013, down from estimated growth of 1.5-percent this year, analysts said.

In comparison, IHS said, the total number of franchised business of all types in the U.S. is expected to rise by 1.4 percent in 2013, to 757,055, after having grown by an estimated 1.5 percent in 2012.

Franchisee outlook pessimistic

Franchising’s quick-service restaurant segment is expected to see 2.2-percent growth in employment in 2013, to about 3.1 million workers, which is down from estimated growth of 2.3 percent this year, IHS said. Franchise systems with table-service restaurants are forecast to see a similar 2.2-percent rate of employment growth next year, to approximately 1.1 million workers, which would also be down from estimated 2012 growth of 2.3 percent.

The franchising industry as a whole is expected to add 2-percent more workers in 2013, which would be down from estimated 2012 growth of approximately 2.1 percent.

“Most franchisees are pessimistic and more of them are pessimistic than franchisors,” IFA board member Aziz Hashim said during the call with reporters in reference to a recent survey of franchise industry leaders. Hashim is president and chief executive of National Restaurant Development Inc. of Atlanta, an operator of 62 restaurants franchised under a variety of brands, including Popeyes Louisiana Kitchen, Domino’s Pizza and Checkers and Rally’s Hamburgers.

Some 36.2 percent of franchisee survey respondents believed the U.S. economy will be worse in the coming year, compared to 22.2 percent one year ago, he explained.

“The survey shows that this sentiment is based on the uncertainty over tax policy, as well as the cost of implementing new health care rules, the continuing credit crunch and the rising cost of energy,” Hashim said. “Small businesses are being hit from every angle, slowing our ability to grow new units and create more jobs.”

Despite such franchisee challenges and frustrations, the IFA indicated that 81.3 percent of the franchisors responding to the survey said their systems plan to add units in 2013, with about half, or 52.3 percent, saying that growth would amount to less than a 6 percent of their existing location totals. However, IFA representatives added, 8.4 percent of responding franchisors indicated they expect to see their unit base decline in 2013, up from 4.7 percent who expected that to occur in 2012.

Contact Alan J. Liddle at [email protected]

Follow him on Twitter: @AJ_NRN