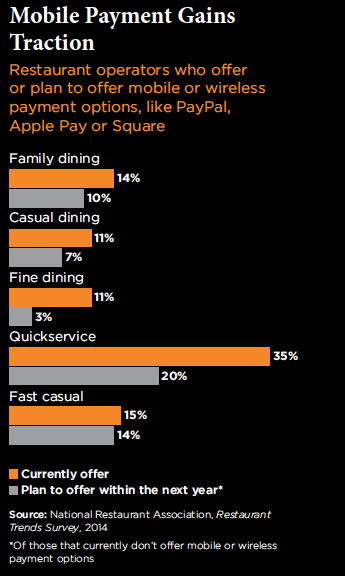

Mobile payment technology is growing fast as a must-have component in the restaurant business, alongside customer demand for speed, convenience and a willingness to use the technology. While many operators rely on third-party services, some have chosen to develop proprietary smartphone apps in house.

“[Technology] has become a part of everyone’s daily life, and this is just the beginning,” said Kevin McCarney, owner of the 10-unit Poquito Mas restaurant group in Los Angeles, which last year introduced mobile payments and online ordering through a third-party provider.

“We are in the hospitality business, and today our guests use technology to connect to friends, to the world and to us as restaurants,” McCarney said.

That adoption has been swift. Roughly one-quarter of consumers say technology options are important features that factor into their decision to choose a restaurant, according to the National Restaurant Association in its 2015 Restaurant Industry Forecast, published in January.

That was an increase from less than 20 percent the prior year, which underscored that “technology rapidly is becoming an expectation rather than a novelty when dining out.”

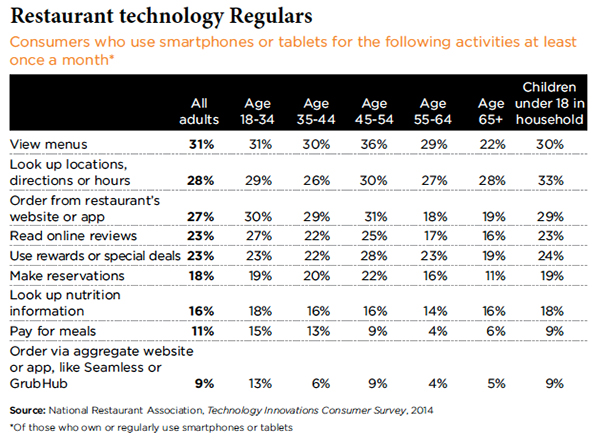

NRA research found 9 percent of consumers at least once a week used smartphones or tablets for meal payment, and 26 percent used it at least a few times a year.

Many restaurant brands look for mobile payment solutions that incorporate other services, such as ordering and loyalty programs, including rewards.

The 21,800-unit Seattle-based Starbucks Corp. has more than 9 million My Starbucks Rewards program members, and many have adopted its smartphone app. While Starbucks has become a gold standard in this regard, smaller brands are finding ways to tap into the all-in-one mobile offerings. In mid-February, Chicago-based Wow Bao, the five-unit fast-casual division of Lettuce Entertain You Enterprises Inc., introduced a branded mobile payment app that includes messaging, online ordering and gift purchases.

In mid-February, Chicago-based Wow Bao, the five-unit fast-casual division of Lettuce Entertain You Enterprises Inc., introduced a branded mobile payment app that includes messaging, online ordering and gift purchases.

“Wow Bao customers can now select a favorite location, buy gift cards, reload gift cards easily and much more with this new version.” Geoff Alexander, managing partner at Wow Bao, said in a statement.

The brand worked with Denver-based Mocapay, its mobile marketing provider, on the mobile app, which includes the points-based loyalty program. Users get one point for joining the program and one point for every dollar spent.

“Once the customer reaches 50 points, they will receive a $5 credit that is automatically provisioned to their Wow Bao app via the mobile wallet,” Mocapay said in a release. The technology also enables in-app messaging, options to request a payment token for secure payment, purchase of gift cards, and online ordering for pickup and delivery. The app is available for both Apple and Android devices.

McCarney of Poquito Mas, which worked with ChowNow for its Apple Pay-based mobile payment and ordering solution, said he was looking for a product that was intuitive, state of the art and affordable.

“We looked at all the options out there,” McCarney said. “We wanted a solution that gave us our own app and did not put us on a list of dozens of others restaurants.”

Poquito Mas began the mobile payment implementation about a year ago, starting with one location, and it added the other units once it saw a performance improvement in to-go sales.

“Guests were quick to embrace the app,” he said. “We saw an immediate increase of over 50 percent in online takeout orders. As we hoped, phone orders began to gravitate to the app, which makes taking orders much more efficient.”

Efficiencies in to-go orders convinced St. Louis-based Panera Bread Co. to fast track its own Rapid Pick-Up, or RPU, offering in its Panera 2.0 initiative to the entire system before other aspects, such as kiosks and table ordering.

Ron Shaich, founder and CEO of Panera, said in a February earnings call with analysts that the RPU expansion was based on the improvements it generated for the chain.

“RPU was originally conceived as an element of Panera 2.0,” Shaich said. “It offers our to-go customers the convenience of ordering and paying for their meals via our website or mobile app and then picking up their order at a designated time. As the name implies, RPU allows customers to grab their orders directly from our pickup shelves without ever having to stand in line.

“After seeing the power of Rapid Pick-Up in Panera 2.0 units, we decided to roll it out fully to the system in 2014 instead of waiting for full Panera 2.0 conversion,” he said. The rollout was completed in the fourth quarter.

Younger consumers are quick adopters

(Continued from page 1)

Rapid Pick-Up is only available online or through the iPhone app with a credit card.

“We expected adoption of RPU to be modest as the customer is still learning about it and how to use it,” Shaich said. “What we've seen has surprised us. Rapid Pick-Up is now representing 3 percent of company transactions. That's today. Again, that's with very little marketing push behind RPU, beyond in-store communications in MyPanera,” which is the company’s loyalty program.

Shaich said he was astounded that about 8 percent of the brand’s sales at the end of the fourth quarter occurred digitally.

“That rate of digital adoption is more than double where we were at the end of the second quarter,” he noted, adding that big box retailers are generating digital sales of 2 percent to 5 percent, and the big pizza brands are seeing digital sales in the range of 35 percent to 50 percent.

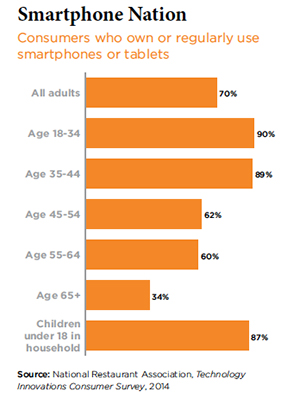

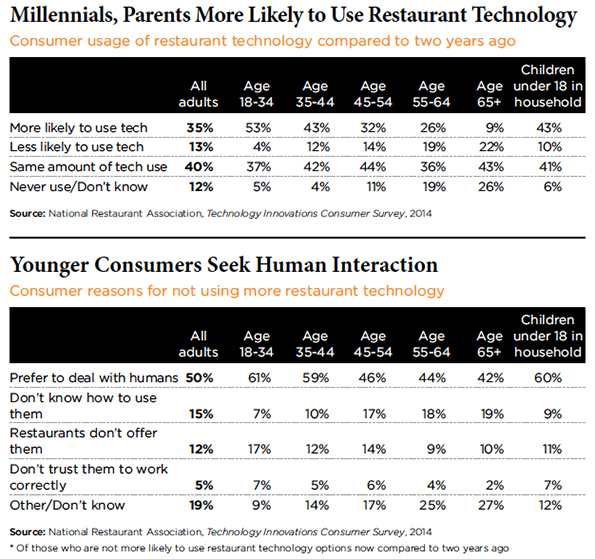

The pizza brands appeal to a younger audience, who are adopting mobile payment technology faster than other demographic groups, according to the NRA 2015 forecast.

“As with most technology-related matters, this sentiment is much stronger among younger consumers,” the NRA noted. “But older generations are starting to increase their usage as well. In addition, people with children under 18 in their households are more likely to say that technology options factor into their restaurant choices.”

Research firm Technomic has found in its consumer research that younger people are increasingly expecting mobile pay.

Jackie Rodriguez, a senior manager at Technomic, said that “it’s a very fluid environment. Things are happening rapidly.”

In a survey at the end of 2014, the Chicago-based researcher revealed that the number of people who had used a smartphone to pay at a restaurant had doubled, to 19 percent, from the beginning of the year. Like the NRA, Technomic found it was younger consumers, a big audience for quick-service restaurants, who were adopting mobile payment at a faster rate than the market as a whole. A Technomic survey in the second quarter of 2014 asked consumers if they were “interested” in mobile payments: overall, 39 percent answered yes, but among consumers ages 25 to 34 years, that number skyrocketed to 56 percent.

Like the NRA, Technomic found it was younger consumers, a big audience for quick-service restaurants, who were adopting mobile payment at a faster rate than the market as a whole. A Technomic survey in the second quarter of 2014 asked consumers if they were “interested” in mobile payments: overall, 39 percent answered yes, but among consumers ages 25 to 34 years, that number skyrocketed to 56 percent.

“Thirty-three percent expect to use their smartphone at restaurants,” Rodriguez said. “Not only are they interested, but they fully expect to use their smartphone to pay at restaurants more often.”

Technomic is closely watching how mobile payment applications are being integrated with other smartphone solutions, such as ordering and loyalty programs.

“The thing to look at is how seamless it is,” she said, referring to Google Wallet, which was introduced in 2011, and Apple Pay technology, which was introduced last October for use with the iPhone 6 and adopted quickly by brands including McDonald’s, Subway and Panera Bread.

“The third leg of that, to complete the cycle, is the tie-in with loyalty programs,” Rodriguez said. “What consumers seem to be receptive to is linking loyalty with ordering and payment.”

She said companies like Starbucks provide a glimpse at that integration. “They are frank about the role technology can play in improving customer service,” she said.

“It’s really exciting,” Rodriguez said. “It’s very competitive, and it can be intimidating for a restaurant. We tell our clients: focus on the function and not the tool. It’s about what you need it to do.”

Contact Ron Ruggless at [email protected].

Follow him on Twitter: @RonRuggless